When to Trade Breakouts and When to Avoid Them

When it comes to trading breakouts, knowing when to seize the opportunity and when to exercise caution can be the difference between success and disappointment. In this article, we will explore the key scenarios that dictate when it's appropriate to trade breakouts and when it's wise to steer clear.

Breakout Trading Basics

Before diving into the specific scenarios, let's establish some fundamental principles of breakout trading. Breakouts occur when the price of an asset breaches a significant level of support or resistance. These breakout points often signify a potential shift in market sentiment or momentum and can serve as strong areas to watch for a trade opportunity.

The Role of Support and Resistance

One essential aspect of breakout trading is the proximity of the market to support or resistance levels. If the market is far from these critical levels, caution is advised. Why? Because it becomes challenging to determine a logical level for placing your stop loss. Even if you do manage to set a stop loss, it frequently results in an unfavorable risk-to-reward profile.

The Three Types of Breakouts

To navigate breakout trading effectively, it's crucial to understand the three primary types of breakouts:

False Breaks: These are situations where the price appears to break out but then quickly reverses, trapping unsuspecting traders. Trading false breaks can result in losses. False breaks are also known as springs or upthrusts, which if identified quickly, can be profitable trading opportunities

Tease Breaks: Tease breaks occur when the price briefly breaches a Support or Resistance level but then retraces. They can be challenging to trade due to their unpredictable nature. Once again these types of breaks are very similar to springs and upthrusts.

Proper Breaks: Proper breaks are the holy grail of breakout trading. These are breakouts that occur with strong momentum on higher than average volume and are supported by robust technical credentials on the chart. Trading these breakouts is more likely to yield favorable results.

Proper Consolidation

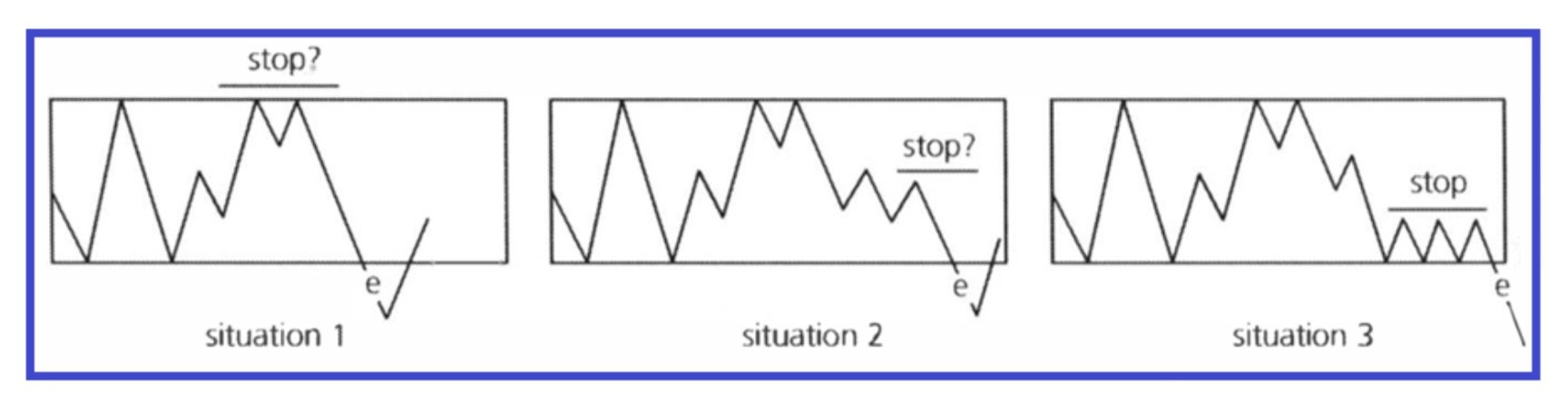

The level of consolidation before a breakout plays a crucial role in determining its potential success. Proper consolidation refers to a period of price stability and tight trading ranges before the breakout. Situation 3 in the image below is an excellent example of this scenario. When the market consolidates properly before a breakout, it enhances the likelihood of follow-through and provides a more favorable risk-to-reward profile.

Scenario-Based Breakout Trading

Now, let's explore specific scenarios to illustrate when trading a breakout is acceptable and when it's best to avoid it:

Acceptable Scenario 1: The market has been consolidating near a significant Support or Resistance level for an extended period. There is a clear breakout with strong momentum, supported by technical indicators. This is an excellent opportunity to trade the breakout.

Acceptable Scenario 2: Proper consolidation has occurred, and the breakout aligns with a broader trend in the market. This scenario provides a higher likelihood of success.

Avoidance Scenario 1: The market is far away from Support or Resistance levels, and there is no clear indication of consolidation or technical strength. Trading a breakout here carries a high risk of failure.

Avoidance Scenario 2: The breakout appears to be a tease or false breakout, lacking the necessary technical confirmation. It's best to wait for a more reliable setup.

Three different breakout scenarios that can be traded - Situation 3 showing what the BEST opportunity is

With situation one in the image above, the market structure pattern is very wide - Meaning that taking a breakout trade puts the stop very far away from the initial entry. A momentum trade can still be taken here, but it is wise to wait for a better setup to develop. In situation two pictured above, we have a scenario that is stronger than scenario one because there is market structure that can be used to place the stop. However, scenario 3 shows what an ideal breakout trade will look like: A breakout with a tight structure developed near the breakout point, allowing you to place a very tight stop while getting involved with this trade.

In conclusion, breakout trading is a potent strategy when executed under the right circumstances. Traders should exercise caution when the market is distant from support or resistance levels and prioritize breakouts with proper consolidation and strong technical support. Understanding the nuances of breakout trading scenarios can help traders make informed decisions and improve their overall trading success to learn more about trading breakouts and developing a profitable trading system, check out the Options Mastery Course.