Price Action

Price action is the foundation of successful trading, offering insights into market movement without relying on complex indicators. This section explores the art of reading and interpreting price charts, focusing on patterns, candlesticks, support and resistance, and key market dynamics. Whether you’re a beginner looking to understand price behavior or an experienced trader refining your skills, these articles provide actionable strategies and techniques to help you trade with confidence and precision. Unlock the power of price action and gain a deeper understanding of market structure.

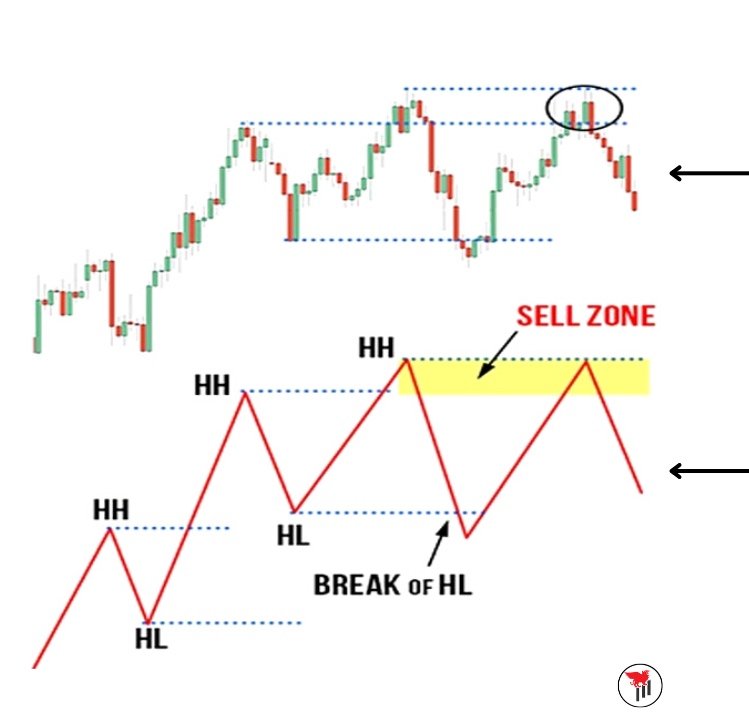

Understanding Market Structure in Trading: A Comprehensive Guide

Market structure is the foundation of technical analysis, offering insights into price movements, trends, and key levels. This article explains what market structure is, why it’s crucial for traders, and how to use it effectively. From identifying support and resistance zones to applying multiple time frame analysis, you’ll learn how to create actionable trade setups and develop your trading edge.

How to Identify and Trade the Spring Setup

The Spring Setup is a powerful trading strategy that capitalizes on market traps and liquidity grabs, particularly in indices like ES and NQ. This article breaks down the mechanics of the Spring, from preconditions to identifying key signals like single candle shakeouts and rapid reversals.

Wyckoff Method: Discover How the Market is Moving

Unlock the secrets of market movements with the Wyckoff Method, a powerful framework for analyzing trends and ranges. This article explores the Wyckoff Cycle, breaking down how price waves, trend strength, and range dynamics reveal the market’s path of least resistance. This is the foundation of our analysis techniques here at Opinicus. Learn how to leverage this time-tested approach to improve your trade timing and profitability.