Springs and Upthrusts - False Breakouts Provide Powerful Signals In Trading

In a fast-paced market, deciphering market signals accurately can be the difference between profit and loss. One such powerful signal that has stood the test of time is the "Spring and Upthrust." Understanding these terms and their significance can unlock opportunities for traders across all timeframes. In this article, we will delve into the mechanics of identifying Wyckoff springs and upthrusts, explore the underlying principles that drive their effectiveness, and discover how these signals can be harnessed for short-term gains or long-term capital growth.

Identifying wyckoff Springs and Upthrusts:

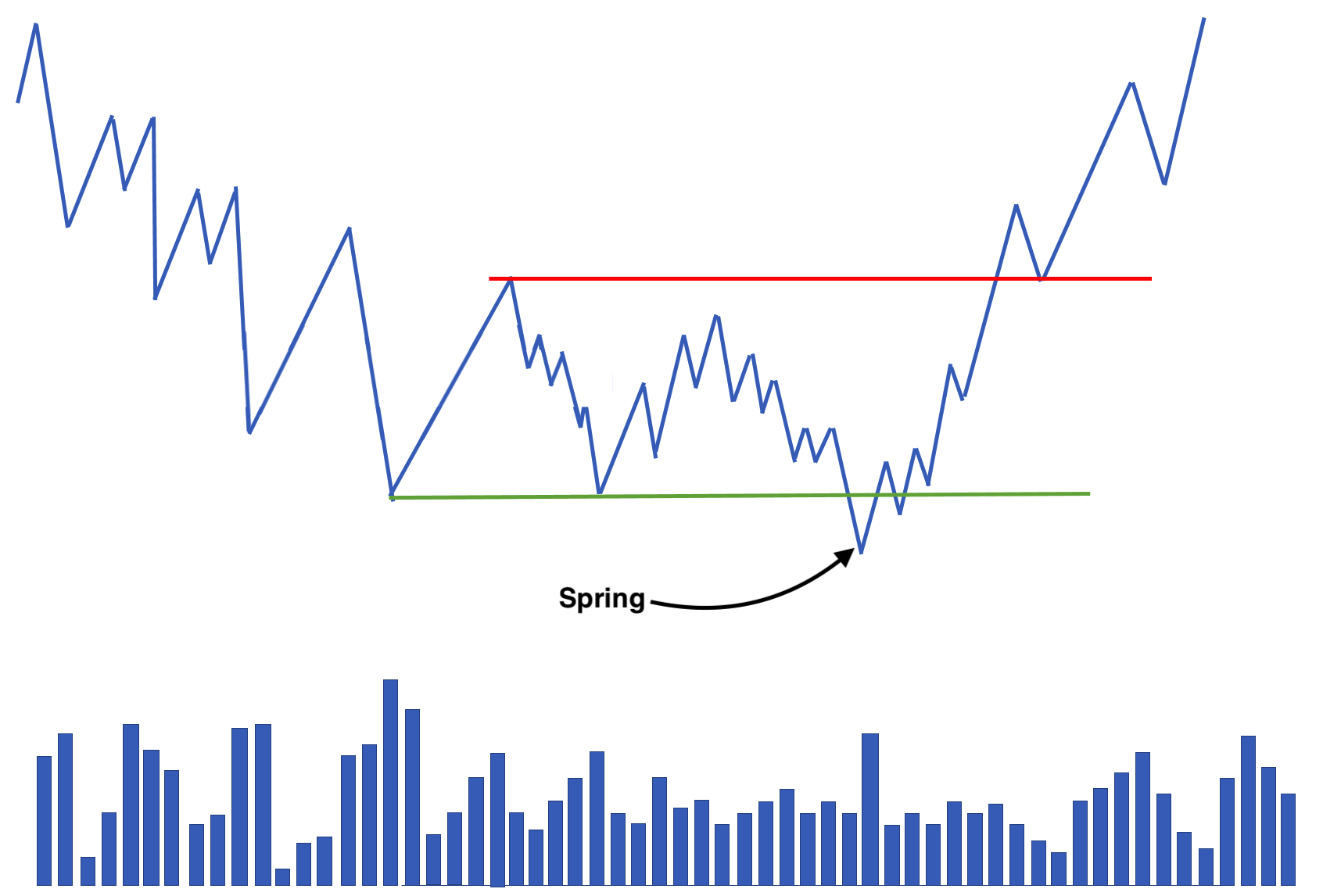

A spring is a market phenomenon that occurs when prices briefly dip below a critical support level before swiftly rebounding back above it. Picture a coiled spring compressed to its maximum, ready to unleash its stored energy. In trading, a spring is akin to this coiled spring, indicating that a potential price surge is imminent.

On the flip side, an upthrust is the mirror image of a spring. It happens when prices breach a significant resistance level, luring in unsuspecting traders who are expecting a breakout, only to retreat back below that level shortly after. An upthrust resembles a trap set by the market, ready to snap shut on unsuspecting traders.

Visual of a Wyckoff Upthrust

To identify a spring, watch for a dip below support followed by a quick recovery. Conversely, an upthrust manifests as a breach above resistance and a rapid retreat below it. Both are marked by swift, convincing price movements that stand out amidst market noise.

False Breakouts: The Concept and Its Effectiveness

False breakouts are patterns that are based on the psychology of market participants. The morph into the tradable setups that we now know as springs (failed breakdown) or upthrusts (failed breakouts). Springs exploit the fear of missing out (FOMO) when prices dip below support, causing traders to rush in as they anticipate a downtrend. However, the market quickly reverses, trapping bears, punishing the chasers, and generating buying pressure. Upthrusts prey on the desire for a breakout when prices breach resistance, drawing in eager bulls only to disappoint them as the market reverses.

This concept works because it taps into the emotional responses of traders. Springs and upthrusts create a false sense of direction, prompting traders to make impulsive decisions. Savvy traders who recognize these signals use them to their advantage by entering positions in the opposite direction, capitalizing on the trapped traders' inevitable exits.

What to do if you’re caught in a false breakout

Breakouts and breakdowns can be great trades in the right environment. However, often times they morph into these upthrust and spring setups. If you find yourself repeatedly getting caught in these false breakouts, take note of the new market-generated information and adjust accordingly. For example, if you buy a breakout and it fails, and you identify a spring setup, you now have a counter-signal that is against your trade. At this point, there is no reason to hold the play to your original stop. New market-generated information presents the counter signal and provides a compelling reason for you to exit the play immediately. If you need help mastering this concept and want to see and review real examples, join us in the Trading Mentorship Group.

In conclusion, understanding the subtleties of market psychology can be a game-changer. Springs and upthrusts are not mere technical patterns but powerful signals that capitalize on traders' emotions and misconceptions. By learning to identify these phenomena and appreciating the psychology behind them, traders can gain a significant edge in their decision-making process.

Whether you are a day trader seeking short-term profits or an investor aiming for long-term capital gains, springs and upthrusts can be invaluable tools in your trading arsenal, and they work on many different timeframes - From the weekly and daily charts to the intraday 2 and 5-minute charts. These signals serve as a reminder that in the world of price action, mastering the mind of the market can be just as important as mastering the charts.