How To Improve Your Trading: 10 Tips For Any Strategy

Discover a trading method that matches your personality

Becoming a successful trader is a journey of self-discovery. It begins with understanding yourself and finding a trading style that aligns with who you are. Most traders get this backward. They look for the strategy and then realize afterward that how you trade has a lot to do with who you are. Are you risk-averse or more inclined to take chances? Do you have the patience for long-term investing, or do you prefer quick, momentum trades? Knowing yourself is the first step toward choosing the right strategy. To find out what your personality gravitates towards and what you do well with, experiment with a couple of different approaches.

Trade with the trend to improve your odds

Statistics show that three out of every four stocks follow the direction of the general market, that is the S&P500 (SPY) or NASDAQ (QQQ). It's essential to recognize that trading against the trend puts the odds heavily against you. For instance, during a bull market, stocks tend to rise, making long positions more favorable. Conversely, in a bear market, shorting stocks can be a profitable strategy. By aligning your trades with the market trend, you increase your chances of success. Calling tops and bottoms is great for the ego, but not for profitable trading. It is cliché, but the trend is indeed your friend.

Stick to your trading strategy despite a few losses

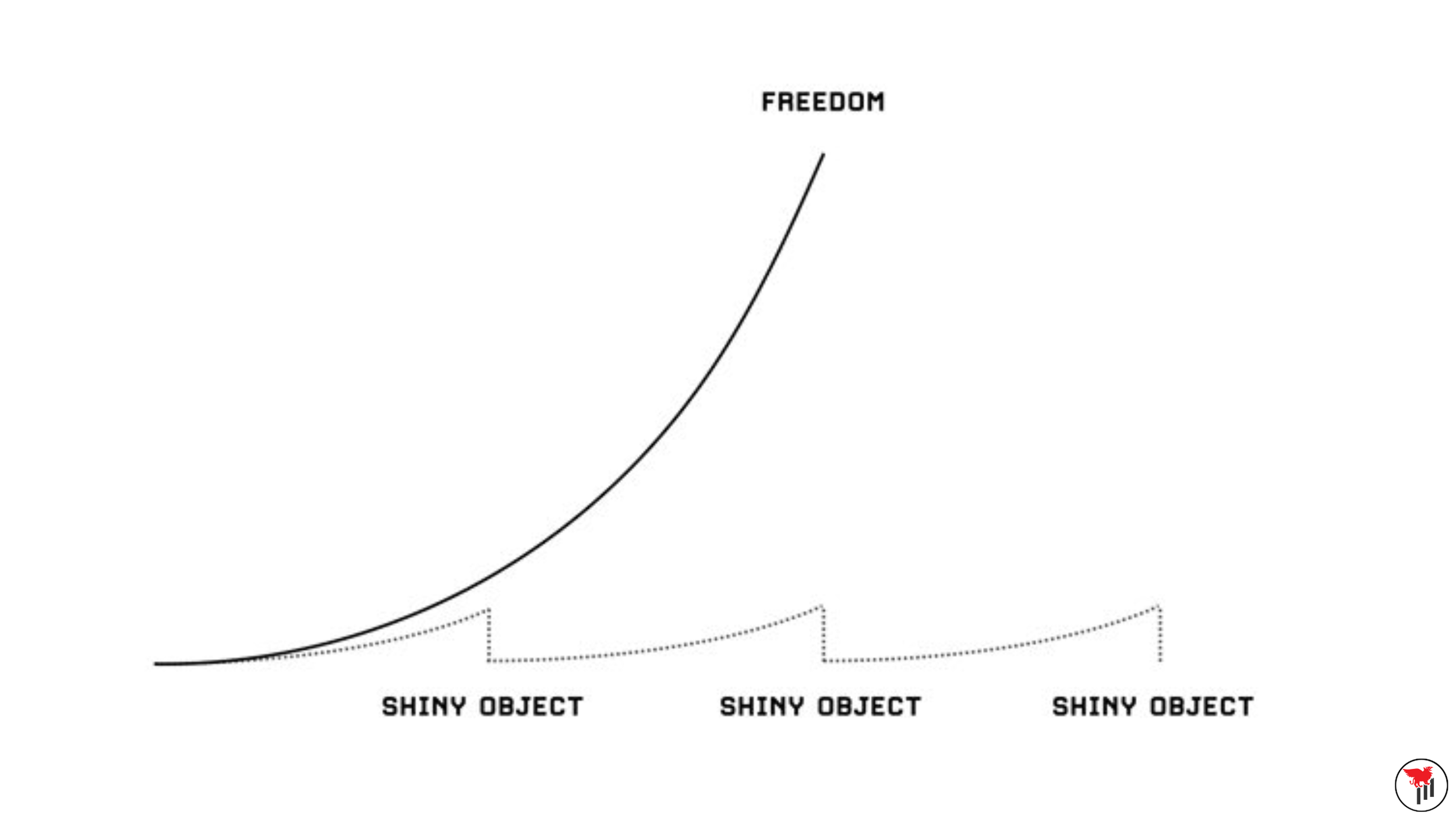

Losses are an inevitable part of trading, even for the most experienced traders. It's crucial not to take losses personally. Sometimes, even when you execute your strategy perfectly, you'll incur losses. Accepting this fact is integral to becoming a consistently successful trader. Remember, trading is about long-term gains, not individual wins or losses. Always keep the big picture in mind and avoid falling into the shiny object syndrome trap. If you’re unfamiliar with shiny object syndrome, it is an important concept to understand - If you want an in-depth review, I talk about it in a recent article titled “How Long Does It Take to Become A Consistently Profitable Trader?”

Shiny Object Syndrome in Trading

Use post-analysis and a trading journal to learn from your actions

Keeping a trading journal is akin to having a personal coach. By recording your trades and decisions, you gain valuable insights into your strengths and weaknesses. Ask yourself: What's working well for me? What am I doing right? Conversely, what's not working, and how can I improve? This self-reflection allows you to fine-tune your strategy continually. I have written a number of articles going over the importance of trade review and keeping a trading playbook because it’s an often overlooked area that will undeniably improve your trading.

Focus on price and volume; ignore unnecessary news

In trading, the only things you truly need are price and volume data. We have a saying in the Trader’s Thinktank, and it is that “only price pays.” While staying informed about current events and market news is essential, it's your reaction to this information that matters. This is encapsulated in the phrase, "price is news." Don't let excessive news analysis cloud your judgment; instead, prioritize technical analysis. News is beneficial for traders because we know it will bring volume into a stock or the broader market.

Specialize in a specific area of market knowledge

Rather than trying to be a jack-of-all-trades, focus on a niche within the market. Become an expert in that specific area, and make it a never-ending learning journey. For instance, if you’re reading this you are likely interested in day trading options or futures (what we specialize in). The depth of your knowledge in your chosen area will give you an edge over traders with a broader, shallower understanding.

Keep it simple, prioritize chart analysis

Success in trading often lies in simplicity. I frequently say in the Trader’s Thinktank that “less is more” in trading. When you focus on what truly matters and do it well, you can make decisions quickly by interpreting price action. Technical analysis, which involves studying price patterns and indicators, can be a powerful tool. It allows you to swiftly decipher what the charts are telling you and make informed trading choices. If you’re new to technical analysis or trading in general, get educated and check out the Options Mastery Course.

Establish essential rules but avoid excessive rigidity

New traders, in particular, benefit from a set of non-negotiable rules. However, too many rules can lead to hesitation when it's time to act. Find a balance between structure and flexibility. Your rules should guide your decisions, not paralyze you. Adaptability is key in the ever-changing world of trading. Remember that your best trading rules will come from your own repeat mistakes - Which will only be uncovered through a trade review process.

Follow relative strength for market insights

Relative strength analysis helps identify stocks that are outperforming the broader market. For example, during a market correction, if software stocks are holding up better than other sectors, it indicates relative strength. Recognizing these trends can guide your trading decisions, as they reveal what institutional investors are favoring.

Identify institutional sponsorship for trading success

Institutional investors account for a significant portion of the market's total volume. Identifying early signs of institutional accumulation can be lucrative, as I have outlined in this swing trading strategy. When you notice institutional interest in a particular stock, consider riding their coattails for potential gains. Monitoring institutional activity can provide valuable insights into market movements.

In conclusion, improving your trading skills is a continuous process. By understanding yourself, aligning with market trends, and adopting these ten tips, you can enhance your trading strategy and increase your chances of success. Remember that patience, discipline, and continuous learning are the keys to becoming a consistently profitable trader.