An Option Swing Trading Strategy That Works

In trading, having a reliable strategy can make all the difference between a profitable system and one that consistently burns money. The Wyckoff Price Cycle, specifically the accumulation base breakout, is a setup that I personally have had great success with - It offers an intriguing approach to option swing trading and is a setup frequently featured in our Swing Trade Radar. This strategy thrives on understanding market phases and identifying key turning points, enabling traders to make informed decisions with the potential for favorable outcomes.

Why This Option Swing Strategy Works

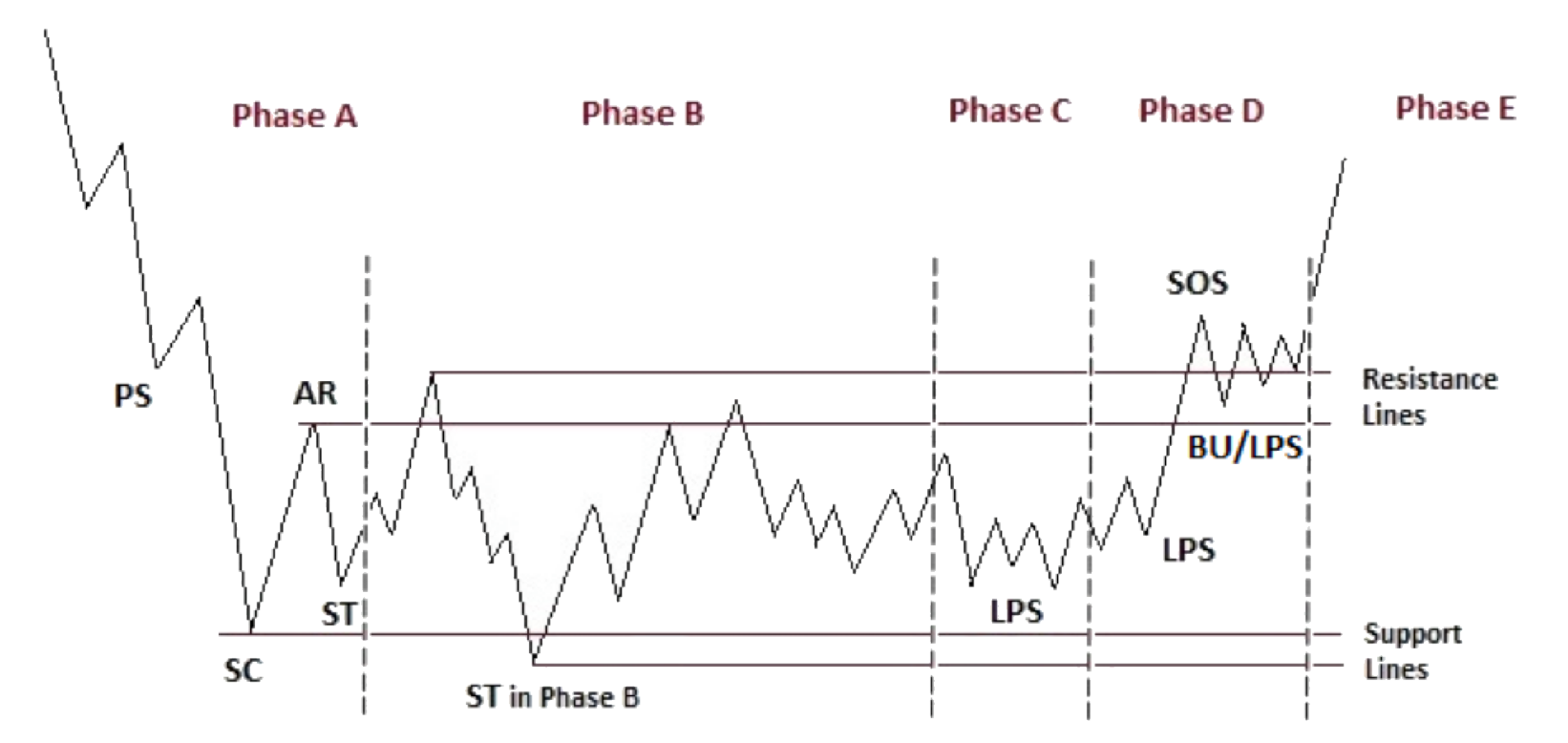

The Wyckoff Price Cycle is a well-defined framework that captures the lifecycle of market trends. Its core, the accumulation base breakout, unveils a methodical pathway for traders seeking an edge. The strategy's efficacy lies in its ability to spot the shift from supply dominance to institutional demand. Recognizing events like preliminary support (PS), selling climax (SC), and automatic rally (AR), sets the stage for a confident entry.

Wyckoff Accumulation Base

When to Enter and Exit Using This Strategy

Navigating the Wyckoff Price Cycle involves strategic timing. Phase A marks the initiation of accumulation, driven by key indicators such as PS, SC, and AR. No entries should be established for a swing long in Phase A. Phase B builds the foundation for an uptrend through institutional accumulation. If you happen to identify the Wyckoff Spring in Phase B, it can serve as a great swing entry and you essentially nail the low of the stock during this period. Phase C's testing of remaining supply, including springs as bullish signals, sets the scene for the next uptrend. Phase D showcases demand's supremacy with advances (SOSs) and reactions (LPSs). Phase D is the best point to get involved with an options swing trade in a stock. Phase E confirms the markup, and ideally, you will still be holding your swing during this phase. As always, for swing trades, we want to identify these patterns on the daily and weekly timeframe charts.

How To Select the Right Option Contract

To align option contracts with this strategy, precision is key but being precise is also challenging. How we position into an options swing helps to negate the precision that is required. When selecting an option contract, optimal strike prices, liquidity, and spreads are essential considerations. Equally important is selecting an expiration period ranging from 3 to 4 months. Always buy more than enough time when choosing your options. This extended timeframe serves as a hedge, affording traders the luxury of time to capitalize on identified phases within the Wyckoff Price Cycle.

In Conclusion, the accumulation base breakout strategy offers traders a structured approach to option swing trading. By harnessing the power of accumulation phases and breakout points, traders can enhance their decision-making, and align themselves with the big picture setup, which are more likely to result in profitable outcomes. As always, rigorous research, risk management, and adapting to market dynamics remain integral to successful trading. If you want to piggyback on our research and swing trades to help develop your understanding of this play and many others, sign up for the Swing Trade Radar by clicking here.