How Long Does it Take to Become a Consistently Profitable Trader?

The Three Trading Variables Every Trader Must Know

Before understanding how long it takes to become a consistently profitable trader (CPT), or why so few traders make money consistently and over the long term - We first must answer the question: What is a consistently profitable trader?

Becoming a consistently profitable trader requires an in-depth understanding and mastery of 3 individual components. While most traders know what these variables are, they are still widely overlooked in the industry - and particularly disregarded in the minds of many developing traders.

The three variables are:

Your average profit

Your average loss

Your hit rate

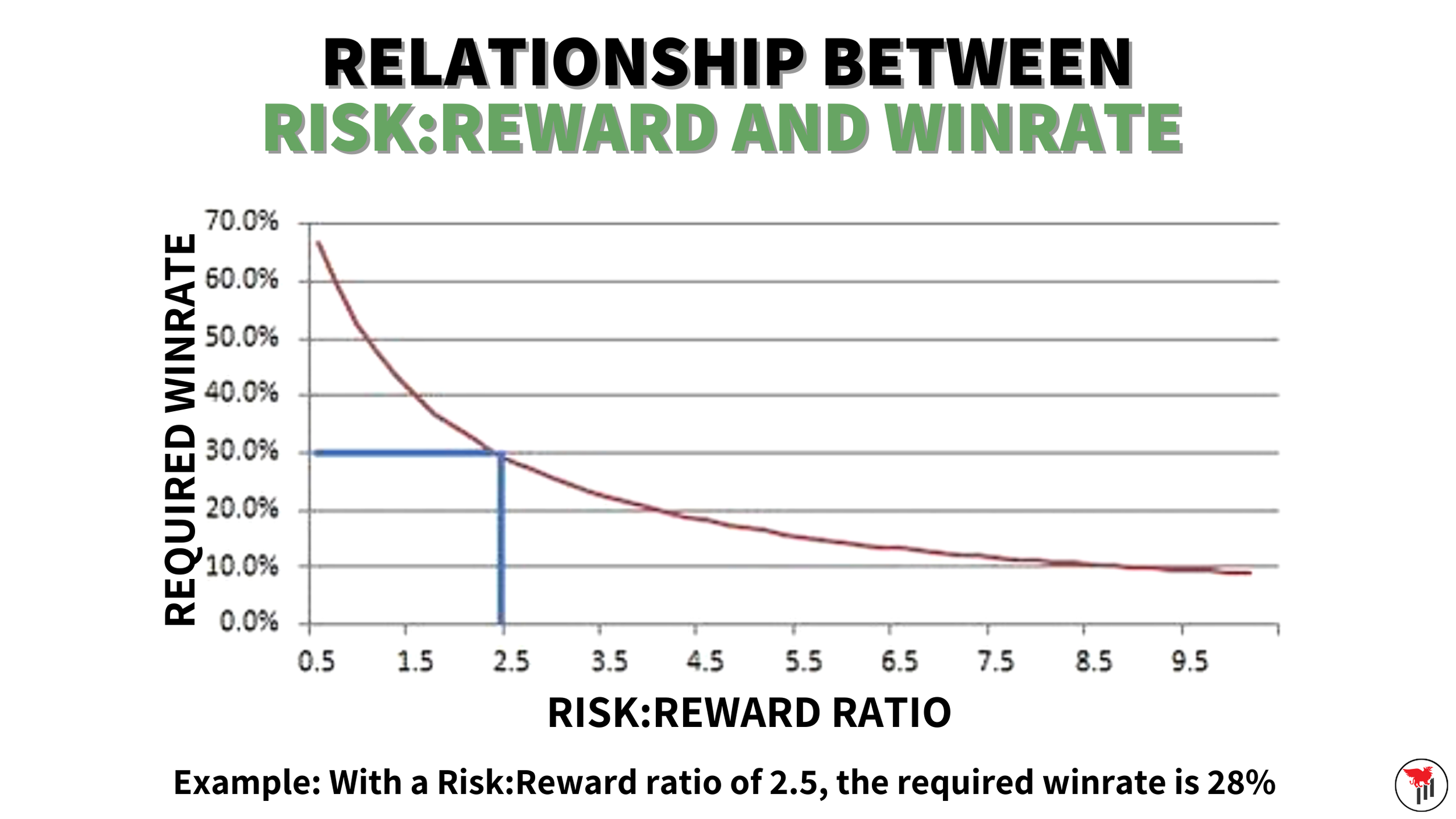

Relationship between Risk to Reward and Winrate

The graphic above shows the neutral expectancy curve, which is the threshold between profitable and unprofitable trading. In essence, what we see here is that the higher your average profit is compared to your average loss, the lower your hit rate needs to be.

Even if your average profit is only twice as large as your average loss, you only need to be right more than 34% of the time in order to be consistently profitable. That means you can be wrong up to 65% of the time and still be profitable!

There is no magic here - A simple understanding of these three variables, and diligently tracking your results, is all that is needed to become a consistently profitable trader.

Why Do So Few Traders Make Money Consistently?

There are a few main reasons why traders repeatedly fail to make consistent money over a long period of time:

1 - Many aspects of trading go against normal human nature

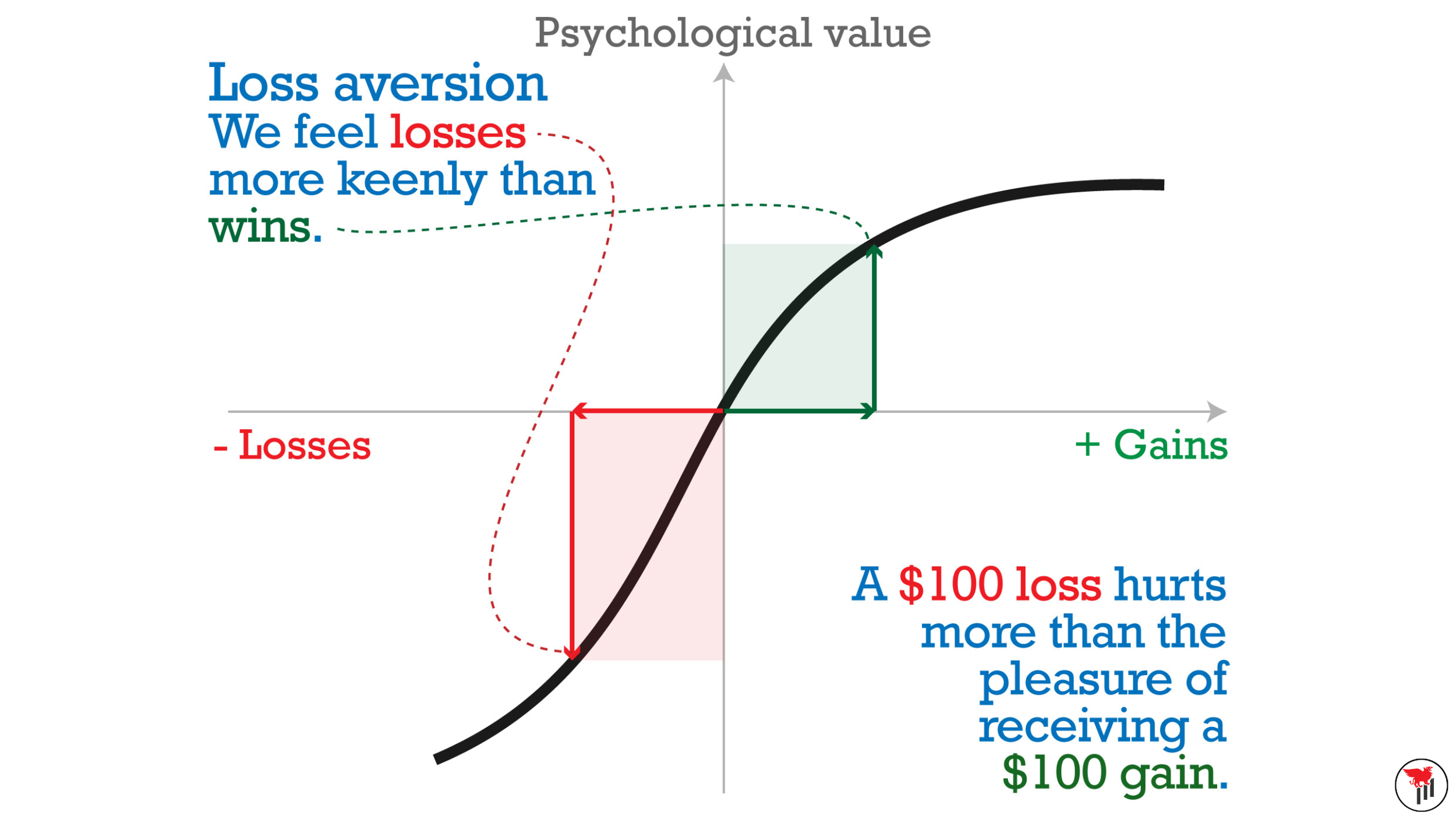

In Kahneman and Tversky’s Thinking, Fast and Slow they discuss the idea of loss aversion. Loss aversion is one of the foundational concepts in the judgment and decision-making literature. Kahneman wrote that “The concept of loss aversion is certainly the most significant contribution of psychology to behavioral economics.”

Psychological aspect of loss aversion

Loss aversion is a natural component of human nature that works against traders by making it more difficult to cut losses short, and easier to secure winners early. In a sense, humans are programmed to do the opposite of what makes a trader successful.

2 - Traders take positions that are too large

Traders also have a tendency to approach the markets underfunded. There is nothing inherently wrong with trading a small account - Though, it can be more challenging to stick with consistent sizing, particularly for options traders.

Even if traders have a system with a positive expectancy and are well funded, if they use inconsistent position sizing they can still fail. I have witnessed this being the demise of many traders - Unfortunately, I am usually hearing about these stories after the damage is done. In most cases, traders seek help and education only after doing catastrophic damage to their account.

Generally speaking, traders are most at risk of a severe drawdown while they are on a hot streak. Being on a hot streak can cause traders to get complacent with their risk and start trading carelessly.

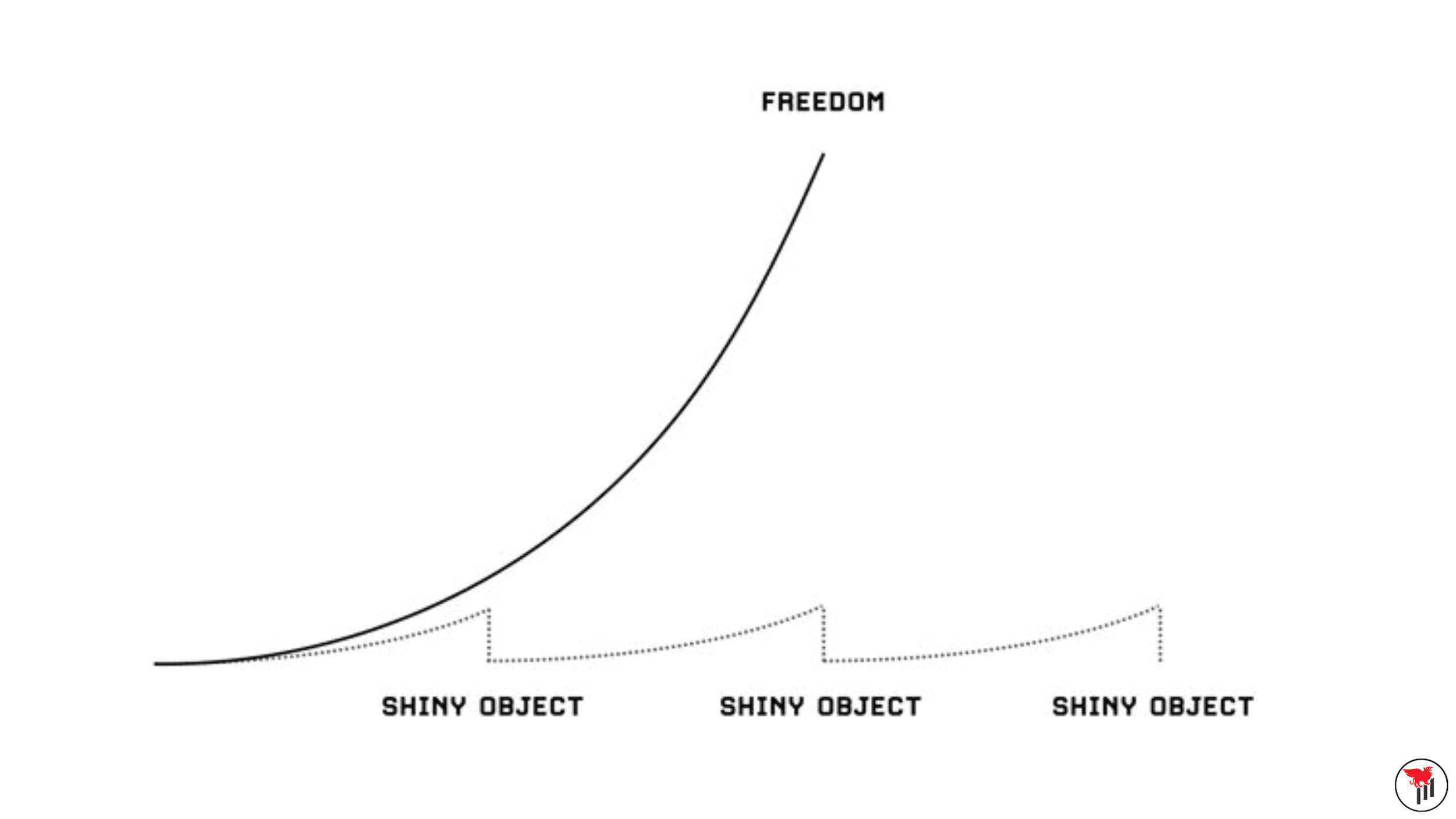

3. System hopping

Developing traders are prone to system hop, which lengthens their learning curve and damages their overall system expectancy and mindset. No trading system is perfect, and even with trading systems that have a high hit rate, traders will still experience slumps or periodic dips in form. During a losing streak, developing traders are more prone to system hop rather than focusing on intensively reviewing their trades. They may see some other trader online who is doing well, and then attempt to adopt their market approach. This is known as the Shiny Object Syndrome.

Shiny Object Syndrome delays a trader’s progress

Let’s remember how you become a consistently profitable trader. Not only do you have to do acquire all of the domain knowledge that the market requires to be great, but you need to have trading passion to propel you forward when times are tough. Great trading is not about having a high IQ, but rather about being able to execute and stick with the process.

Overall, I’ve observed that traders (particularly those in their early development) are underfunded and misinterpret what stage of their trading career they are in. They want money quickly, they have seen someone online make trading look easy, and they have no real passion for trading or the journey associated with becoming a trader.

This results in an overestimation of their own ability which usually means trading with size that is too large for their account and skillset. Once that first outsized loss is taken, developing traders tend to get into a “make it back” mindset and end up swinging for the fences - This only ends one way, and it’s with an account blow-up. If this sounds familiar, it is because it is a tale that is all too common in the trading industry.

Time and Capital Investment

How much time does it take?

Time investment before reaching the consistently profitable status is going to vary widely based on trading education and how many hours per day can be dedicated to the craft. There are individuals at top Wall Street trading firms who struggle to find consistency even after 12 months of consistent 40-hour weeks dedicated to the craft. Others at the same firm are in the breakeven (or better) stage after just a few months.

Given an identical environment and education, why is there such a large discrepancy in results?

There are two main themes in trading: market understanding and self understanding. Trading is a journey that requires a great degree of self-awareness and self-mastery. Very few realize this when they get into trading, but only those that are willing to master these aspects will find lasting success in the markets.

The more time traders commit on a regular basis to understanding price action, learning a strategy, and practicing (via paper trading or small-size trading) the more quickly they will become a consistently profitable trader. There are a handful of ways to practice without actually trading:

Review your trades

Watching price action in realtime

Document and annotate trade setups that make sense to you

All three of these are going to help develop long-term and visual memory through repetition.

How to Learn and Practice

As mentioned previously, traders need to have a high baseline of domain knowledge. One of the best ways to learn how to trade options is through the Options Mastery Course or One on One Mentorship program that we offer. Learning a proven trading strategy and how to develop your own system is a great way to shorten the learning curve. Once you have a system, it is all about resisting the urge to deviate from that system, and engaging in deliberate practice.

Remember though, practice doesn’t make perfect. Perfect practice only creates improvement. If you practice the wrong things, or do the same wrong things over and over, you’ll continue to struggle no matter how many hours you are putting in. After more than 6 years of trading full-time I still make mistakes, but I spot them quickly and work on them, which means the number of mistakes tends to decline.

Traders have to have a great degree of self-awareness and take responsibility for their results. Every serious trader needs a robust review system, and part of that is looking at your strategies and objectively noting if there is a better way of doing things. If a strategy worked, but no longer is, ask yourself why. Did market conditions change? Is there more or less volatility than before? Are you just barely getting stopped out or are you completely wrong? Such questions help you isolate the problem - I go over some of the most productive ways to review trades in this article.

Maintaining Consistency As a Trader

Many traders can string together a few months of profitability, particularly in “easy money” conditions. Unfortunately, these good times never last. Maintaining profitability is a tougher challenge.

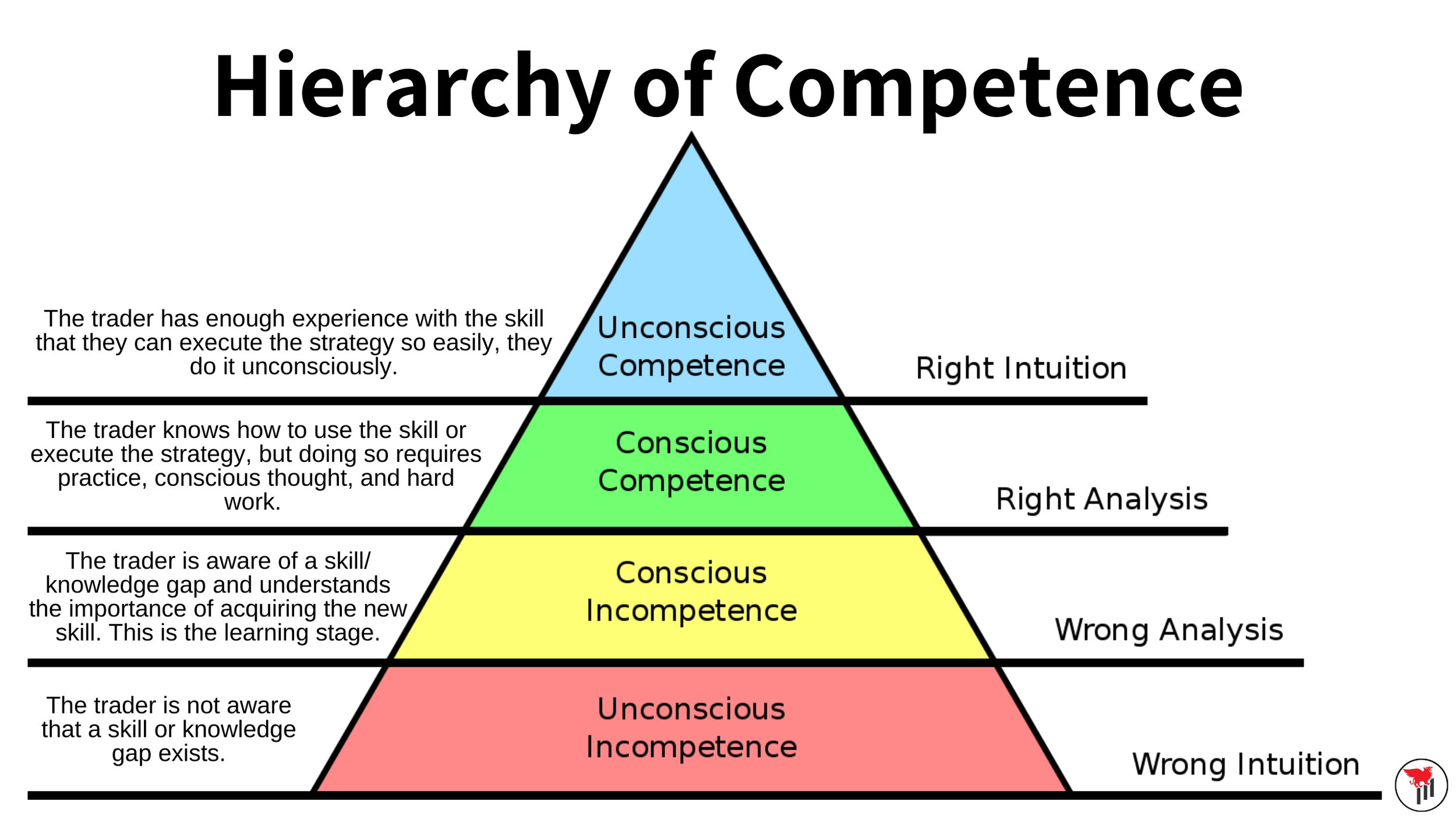

Hierarchy of Competence in trading

The Hierarchy of Competence suggests that there are 4 stages of learning, and this applies directly to a trader’s education. If you become consistent for multiple months you are in stage 2, and potentially stage 3. Stage 4 is reserved for traders who have experienced turbulent times, such as a massive shift in market conditions (bull to bear market) or experienced a long slump and managed to get through it.

How Long Does it Take to Become a Consistently Profitable Trader?

I can’t tell you how long it’ll take to become a profitable trader because it depends on many factors such as which stage you’re currently at, your attitude towards trading, daily time commitment, quality of the review, etc. In Gladwell’s Outliers, he states that it takes 10,000 hours of intense practice to master a complex skill. Every trader needs to ask themselves if they are willing to commit a few years of their life to their trading development while knowing that the results during this period could be minimal. Progress takes time, and that is especially true when it comes to day trading.

That being said, after directly helping and observing hundreds of traders on their journey to profitability, here are things to consider:

Insisting on being “self-taught” will set you back months, if not years. Trading is much harder without a strong base of knowledge and an understanding of what a profitable trading system looks like. Experience is the most expensive trading skill, and “paying the market” for your trading education could be tens of thousands of dollars (in losses). Get educated, and join a trading community like the Trader’s Thinktank. You don’t know what you don’t know.

Prepare to put in a minimum of 6-12 months (working on a single strategy) before you develop enough consistency to see a profitable month. Strategy hopping and any “unlearning” of bad trading behaviors are going to lengthen this 6-12 month timeframe. If you reach the point of having a profitable month, from what I’ve seen those monthly profits are likely to continue. Keep in mind that this will likely be a relatively low level of profitability - You won’t want to replace your other sources of income with trading after a single month of profitability.

When adapting to new market conditions (or learning markets for the first time), put in at least several hours a day. If you are only putting in an hour a day, it could take you longer to become profitable. This does not mean trading all day! When you aren’t practicing by placing trades, you are looking at charts, studying patterns, reviewing past trades, and working on your mental game.

Remember that progress is cumulative in science and engineering but will be cyclical in trading. You may experience weeks and months at a time where it feels like progress is stagnant. Keep going. You are likely much closer than you think.