How to Identify and Trade the Spring Setup

The Wyckoff Spring, commonly referred to in the Trader’s Thinktank as the Spring Setup (also known as a shakeout) is one of the most effective and profitable setups for day traders, particularly those focusing on index products such as ES/SPY or NQ/QQQ. This setup is a powerful tool because it focuses on traps - Enabling savvy traders to capitalize on market movements that are driven by large players. Here’s a detailed guide on identifying and trading the Spring setup.

Understanding the Spring setup

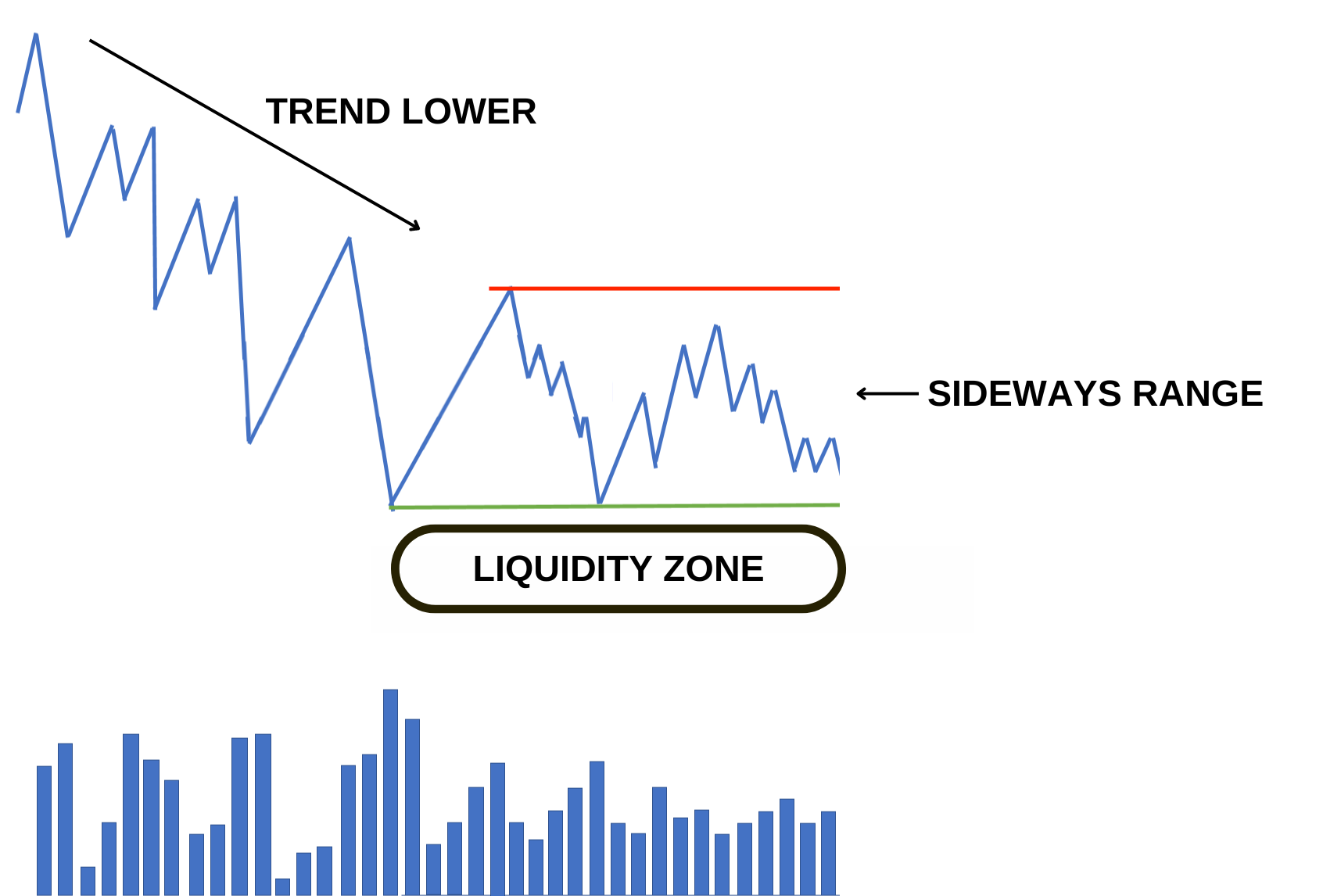

The Spring occurs after large traders have built up their positions. This event acts as a turning point, initiating a trend movement that takes the price out of a trading range. Put more simply: The spring occurs after a trend lower or drop in price, followed by sideways action or a range. As the range develops, more traders identify the structure and position themselves accordingly. With more and more market participants, the stops placed below the local structure create a large liquidity pool. The Spring setup involves a false break of a liquidity area, where the price initially appears to be moving in the direction of the breakout but then reverses. This action is crucial for large traders to absorb pending orders and initiate the expected trend, which typically results in an explosive move. For this reason, the Spring setup is one of our most frequently traded and discussed plays in the Trader’s Thinktank.

Understanding the Spring Setup - How it Develops

Preconditions for a Spring

Before anticipating a Spring setup, two key actions must occur:

Halting the Trend and Establishing a Range: The prior trend comes to a halt, and the market starts moving sideways, creating a range or market structure. This indicates that the momentum has paused, and traders are preparing for the next significant move.

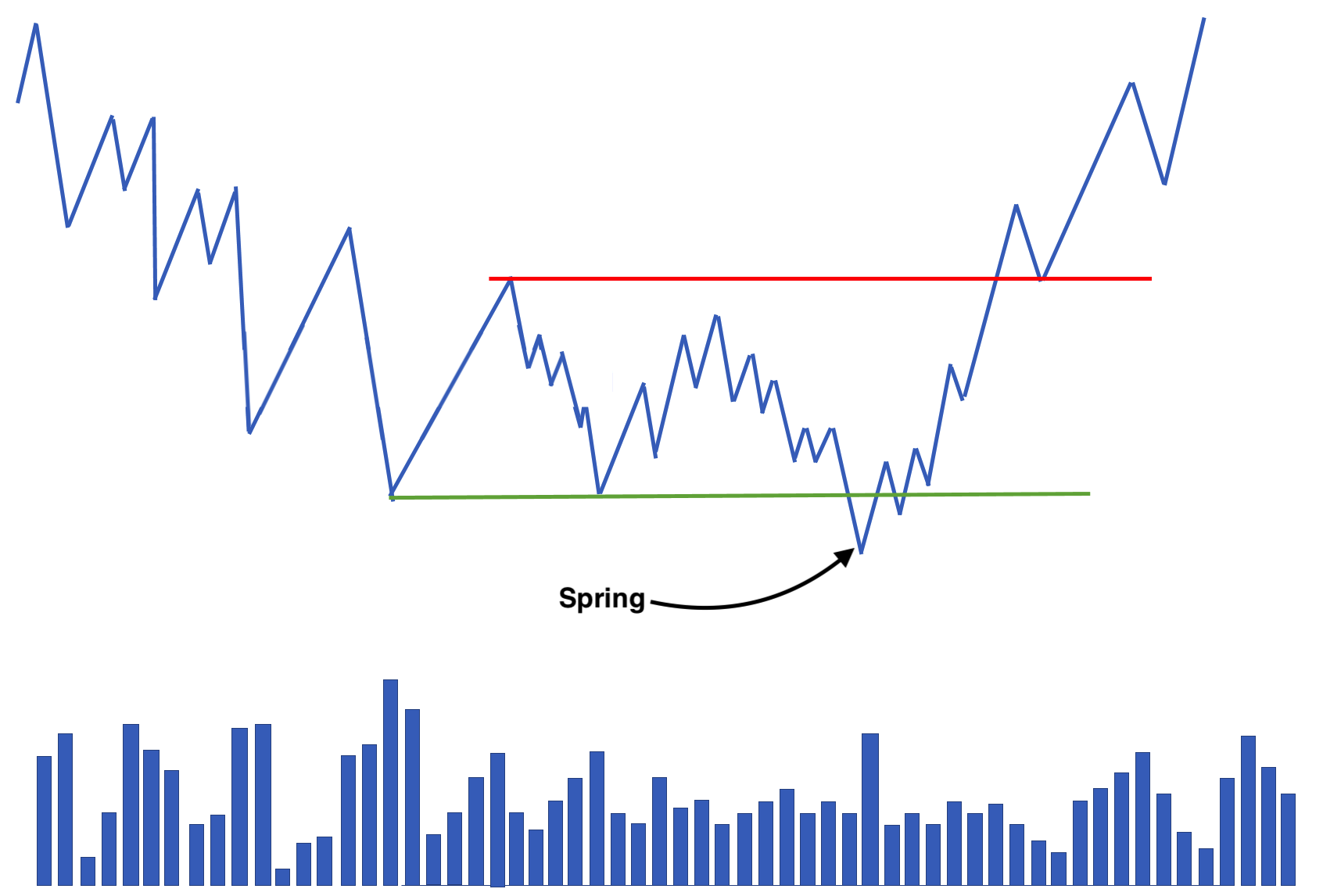

Liquidity Trap and Rapid Reversal: The price initially continues in the direction of the main trend, breaking below the established range to grab liquidity. This move attracts more traders to enter the market, thinking the trend will continue (breakout traders shorting the new low). However, the price quickly reverses, indicating that the large traders have absorbed these orders and are now driving the market in the opposite direction.

Schematic of the Spring Setup

Mechanics of the Spring

Financial markets operate based on the law of supply and demand. For any order to be executed, it must be paired with an opposite order. In the context of a Spring, large traders absorb orders from weak hands (ill-informed or poorly positioned participants) and use this liquidity to drive the market.

The key to analyzing a Spring setup is to determine the aggressiveness with which the key zone is broken and the market’s immediate reaction. The action involves breaking a previous liquidity area, triggering any long stops while also creating the illusion of a genuine breakout to attract more traders to short. Once enough orders are absorbed, the price reverses, trapping most market participants and initiating the desired trend movement. Once the trap is identified, the setup is just about ready to be entered.

Identifying the Spring setup on the Chart

The Spring can manifest in several forms on a chart:

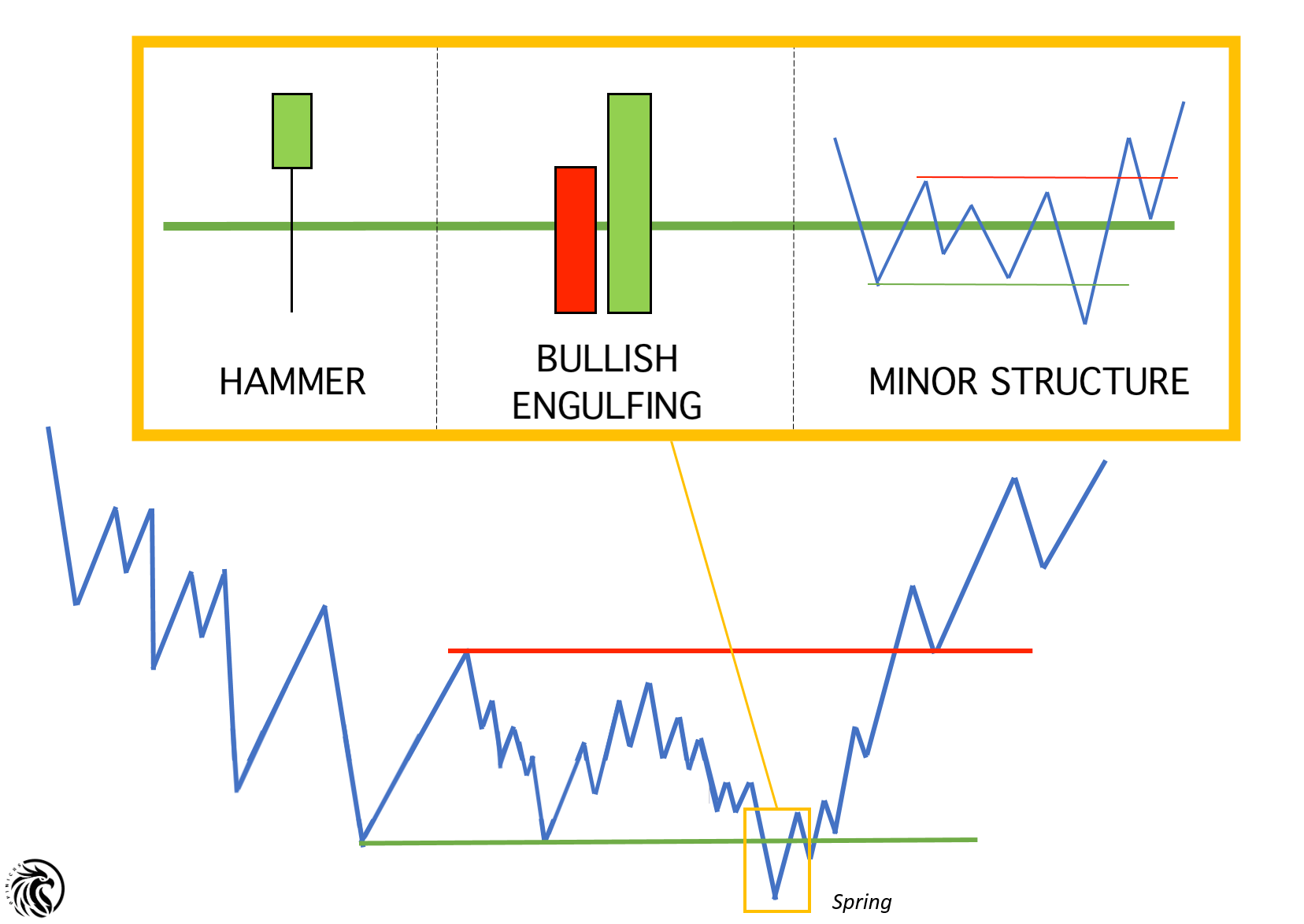

Single Candle Shakeout: Often seen as a hammer candle, it penetrates the liquidity zone and reverses within the same candle, leaving a significant tail. This indicates a strong rejection of lower prices and the presence of aggressive buyers. This is perhaps one of the best signals for the spring setup.

Multiple Candle Pattern: Similar to the single candle shakeout but develops over several candles. The longer the reversal takes, the weaker the shakeout, and the less likely it is that you have a high quality Spring setup to work with.

Minor Structure: The price stays within a potential shake position for a longer period. This often involves a smaller accumulation structure that eventually triggers a bullish turn. Think off multiple overlapping candlesticks showing no real direction.

Identifying the Spring Setup

Functions of the Spring Setup

The Spring setup serves several purposes for large traders:

1. Trapping Breakdown Traders: Those who enter the market to the short side thinking the breakdown will continue add pressure, which the large traders use to absorb more orders.

2. Shaking Out Fearful Traders: Traders that had the right idea but entered too early for a reversal are now shaken out of their losing positions, adding to the order absorption. This usually creates the largest order pool below the structure/range lows.

Trading the Spring setup

Before getting into how to trade the spring setup, know that this setup is more advanced and is more challenging to master. If you are a new or beginner trader (unprofitable and/or years 1-3), consider mastering a setup like the Two Hour Trader framework to develop baseline profitability before incorporating the Spring setup into your playbook.

To effectively trade the Spring setup, follow these steps:

1. Identify Preconditions: Ensure the previous trend has stopped and a significant low has been constructed.

2. Observe the Liquidity Zone: Watch for a break of the liquidity area. Pay attention to the volume and price action.

3. Wait for the Reversal: Look for a rejection of the breakdown. This could be a single candle with a long tail or a series of candles indicating a reversal. How quickly is the breakdown absorbed? Typically, I like to see very quick absorption here with priec pushing back into the prior range within the same candle.

4. Enter the Trade: Once you confirm the reversal, enter the trade in the direction opposite the initial breakdown. Place your stop loss below the low of the shakeout for long positions or above the high for short positions.

5. Monitor the Trend: As the trend develops, manage your trade by adjusting your stop loss to lock in profits.

Conclusion

The Spring setup is a potent strategy for day traders, particularly in index markets. By understanding the mechanics and preconditions, and by carefully observing price action and volume, you can effectively identify and trade this setup. There are many nuances involved with this setup, so it will take time to master. if you need help with the details, join the Trading Mentorship Group - This is one of our favorite setups to discuss, trade, and analyze. Mastering the Spring can elevate your trading skills, allowing you to stay profitable in a wider range of market conditions.