How to Use the Volume Point of Control (VPoC)

In trading, understanding market sentiment and identifying key price levels in which you want to be involved is crucial for making informed decisions. One common issue I have observed through working 1 on 1 with developing traders is their frequency of taking trades in “no man’s land” - Which can be better described as an area on the chart without any notable market structure or relevant levels. One powerful tool that helps traders engage with price in better locations is the Volume Point of Control (VPoC), a vital component within the Volume Profile indicator. In this article, we will explore the significance of VPoC and how it can be leveraged by traders to enhance their market analysis and decision-making.

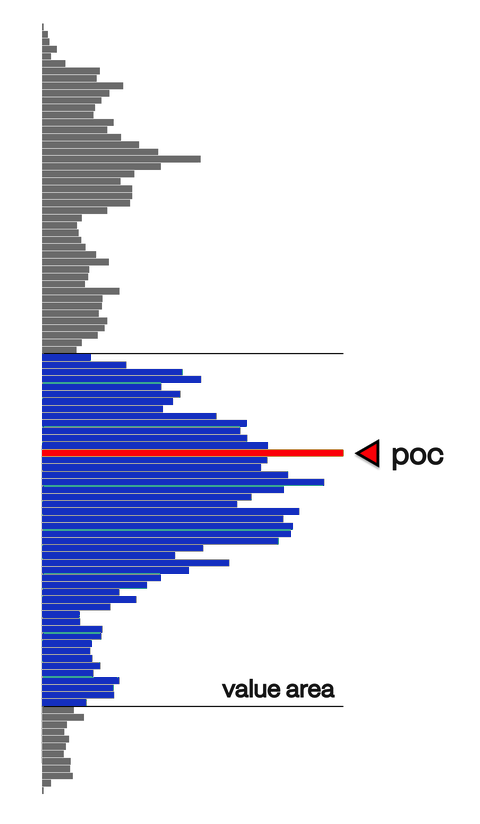

Understanding Volume Point of Control (VPoC):

Volume Point of Control Within the Profile

At its core, the VPoC is not an independent indicator but a critical element within the Volume Profile (Volume By Price) indicator. Volume Profile is a charting tool that displays the volume traded at different price levels over a specified time frame. The VPoC represents the price level at which the highest volume of trades occurred during that designated period.

Significance of VPoC:

Identifying Market Interest: The VPoC acts as a magnetic point on the chart, highlighting the price level where market participants showed the most interest. This level often serves as a focal point for traders, as it indicates a consensus among market participants.

Price Relevance: Traders use the VPoC to identify areas of price acceptance, where the market has agreed upon a fair value. This level becomes significant for future price movements, as deviations from the VPoC can signal shifts in market direction. As a general rule of thumb, if price is above the VPoC, it is safe to assume that the transactions near VPoC were showing accumulation.

Market Auction Theory: The concept of VPoC aligns with Market Auction Theory, suggesting that markets operate as auctions. The price at which the most volume is traded reflects the equilibrium point, where buyers and sellers find agreement. Traders can use this information to gauge potential support or resistance levels. Often when price is trading in a range, the VPoC can serve as a strong reference point for establishing an entry. In the Trader’s Thinktank, we commonly treat a range’s VPoC as a mid-range reference point.

Intraday and Longer-Term Analysis: VPoC is adaptable for various time frames, making it valuable for both intraday traders and those with a longer-term perspective. Short-term traders can use the VPoC to identify intraday levels of interest - Both on the near-term (15-30 minute) structure as well as the current session. while long-term investors and swing traders can leverage it to identify critical support or resistance levels on higher time frames such as the daily and weekly charts.

Incorporating VPoC into Trading Strategies:

Confirmation of Trends: Traders can use the VPoC to confirm the strength of prevailing trends. If price is consistently trading above the VPoC, it may indicate a strong bullish trend (accumulation), while prices below the VPoC may suggest a bearish sentiment (distribution).

Reversal Signals: Reversals often occur around the VPoC, especially when prices approach the point from one side and then quickly reverse. This can signal a potential reversal in price and serve as a trigger for traders looking to enter or exit positions. As mentioned previously, the VPoC is a great location for traders to get involved.

Risk Management: The VPoC can be a valuable tool for setting stop-loss levels. Placing stop-loss orders near the VPoC can provide traders with a reference point where they may reconsider their positions if the market moves against them.

In conclusion, traders need tools that provide an edge in decision-making. The Volume Point of Control, embedded within the Volume Profile indicator, emerges as a powerful ally for traders. By understanding and incorporating the VPoC into their analyses, traders can gain insights into market sentiment, identify key price levels, and make more informed trading decisions that improve profitability. As with any tool, traders need to integrate the VPoC into a comprehensive trading strategy and use it in conjunction with market structure to enhance their overall market analysis.