Market Data

Goldman Sachs: "Friday was the highest put option volume session in history.”

The Put/Call Ratio closed at 1.35, which is the highest level since the start of the pandemic. This is with a VIX at 30, which is substantially lower than the last time the Put/Call ratio visited this level.

There is attention being paid to the record-breaking “put buying” (by small lot traders, 1-10 contracts) and put volume traded data that was released by the Options Clearing Corp on Friday.

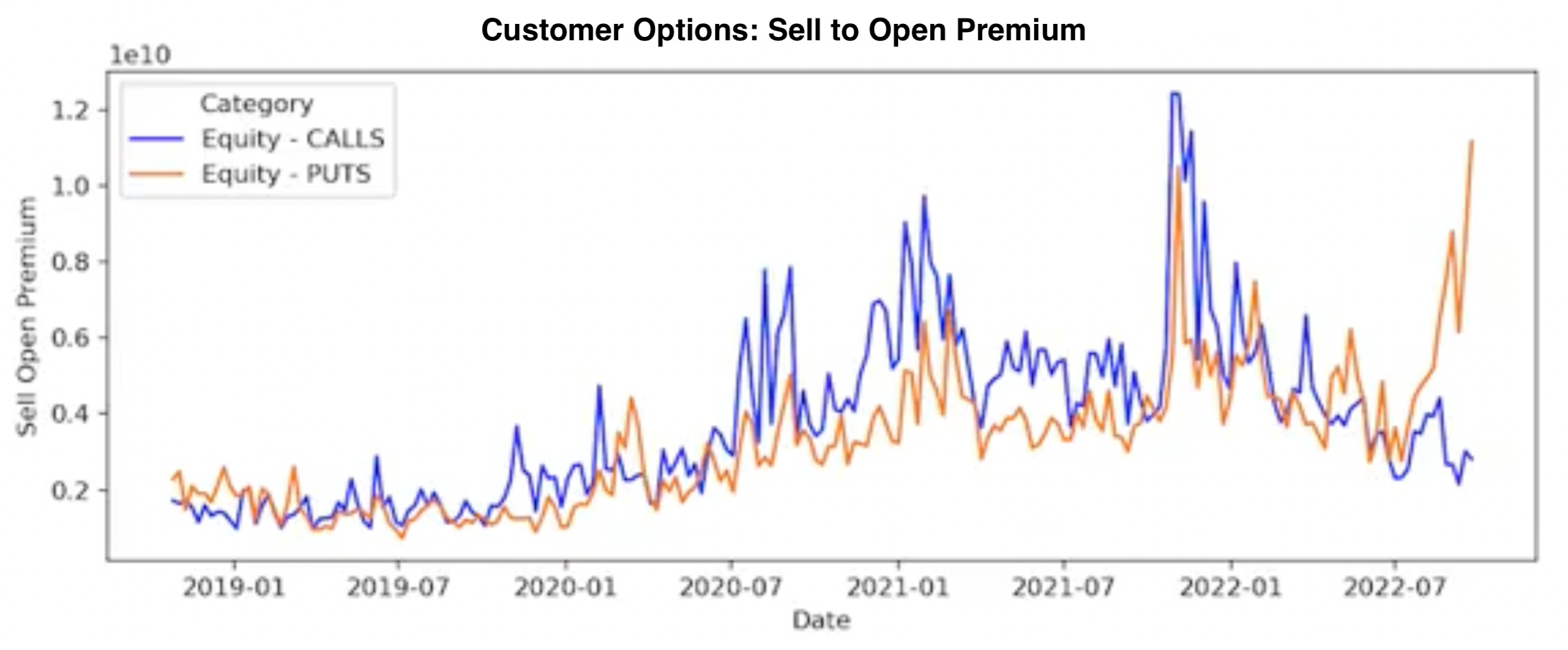

While this is true, the headlines which are grabbing attention fail to address one key aspect here - The sell to openpremium that was also done on Friday. This premium is also at a record level, surpassing the size that was sold to open in 2021.

What does this mean?

To put it simply, the buying (to open) and selling (to open) offset each other. The massive volume done on Friday was not purely buying, and nor was it heavily biased towards retail either.

While pouring over the data from the OCC, we came across an interesting find that isn’t being talked about - The ETF (QQQ, SPY, etc) flow.

Total premium bought and sold (for both open and close) shows levels not seen since 2020. This is indicative of heavy puts being closed (or sold to open) in this past week. This has been associated with near-term bottoms in the past, so something to keep in mind. This is perhaps the most interesting piece of data from Friday’s close.

Only 4.4% of S&P500 components are above their respective 50-day MA currently.

This was > 90% as recently as Aug 18th.

Breadth is helping to confirm this move lower.

The S&P500 net high/low breadth metric is also helping to confirm the move lower as well, showing a -538 as of Friday’s close.

We like to look at a few of these breadth metrics to get an “under the hood” view of the market.

Opinicus Updates

This past week had some tricky action, what we like to call “base-hit discipline” trading, especially in those days leading into the FOMC rate decision. Thankfully we still managed to get involved with some great trading ideas. Here are a few of the highlights in individual stocks 👇

What’s Happening This Week?

A Review of the S&P500 Technicals

The index is currently down ~10% in 10 trading sessions and exploring prices near the June lows. In last week’s note, we mentioned that sellers remain in control of this market (as evident by the weekly bearish engulfing candle, among other things) and to potentially watch for a test of the ~370 zone and June low. That move has been completed, with price trading with 1% of the June low.

Despite FOMC and various other market catalysts, this market continues to trade very technically. Friday’s session did find some buyers into the close - Whether that bounce lasts through next week remains to be seen, but the current levels are a reasonably strong area of potential demand. Heading into this week, the main focus is how price reacts versus the June low at ~362.

Should price see an oversold bounce versus this area of demand, there are clearly defined areas of resistance to be monitoring at the 370 (zone), 377, and 385. Should the recent weakness continue, the weekly chart shows 350 as the next major level of interest and potential area of demand. To reiterate, reaction versus the June low will likely set the stage for price action for the next couple of weeks.

Monday

(10:00am) Fed Collins Speech

(12:00pm) Fed Bostic Speech

Tuesday

(8:30am) Durable Goods Orders Report

(10:00am) CB Consumer Confidence

(all day) - Intel (INTC) will holds its annual innovation conference. Intel Innovation 2022 will include a keynote address by CEO Pat Gelsinger and updates on the 13th Gen Intel Core series. Shares of Intel are down 48% YTD.

Wednesday

(8:35am) Fed Bostic Speech

(10:10am) Fed Bullard Speech

(all day) Amazon (AMZN) will hold an event to announce new devices, features, and services. The product event could include new Echo devices, as well products from the Ring and Blink subsidiaries.

(2:00pm) Fed Evans Speech

Thursday

(8:30am) GDP Growth Rate QoQ Report

(1:00pm) Fed Mester Speech

Postmarket earnings: MU, NKE

Friday

(8:30am) PCE Price Index Report

(10:00am) Michigan Consumer Sentiment Report

(all day) Tesla (TSLA) will hold its long-awaited AI Day event in Palo Alto, California. The buzz is that Elon Musk and team will have an operational Optimus prototype to show off. That could reset expectations on the value of a Tesla Bot business and highlight that the Austin-based company is a tech player as much as an automaker. Analysts think creating a working prototype will move the company up a few notches if a production date for the first version of Tesla Bot is seen as being closer.

(all day) Li Auto (LI) will host a launch event to unveil Li L8, the Chinese automaker's six-seat, large premium smart SUV.

This Week’s Interesting Thought

Widen Your Time Horizon

Thinking in decades avoids a lot of bad behavior.

If you think about relationships lasting decades, you'll often handle the current moment differently. This works for co-workers, partners, suppliers, customers, friends, etc.

Think twice before you interrupt time.

How can you apply this to your trading?

A few ways that work for me: Thinking in hundreds of trades, not the latest trade. Remembering to always trade for tomorrow, and not burning your account on any singular trade idea.