Treating Trading As a Business - An Important Concept for Traders

When it comes to trading, you often hear the advice to treat it like a business if you want to achieve success. But what does that really mean? Let's delve deeper into the concept of trading as a business to gain a comprehensive understanding. By exploring various aspects, we'll uncover valuable insights that can elevate your trading skills and transform your approach into a more business-oriented mindset.

Your Setups as Products and Services

In any business, the key to generating profits lies in selling products or services. Similarly, as a trader, your setups and strategies serve as your products. These setups are like a well-defined set of rules and triggers that guide you toward potentially profitable trades. Whether you rely on classic patterns, indicators, pure price action, or a combination thereof, what truly matters is that you become the expert in your chosen setups and patterns.

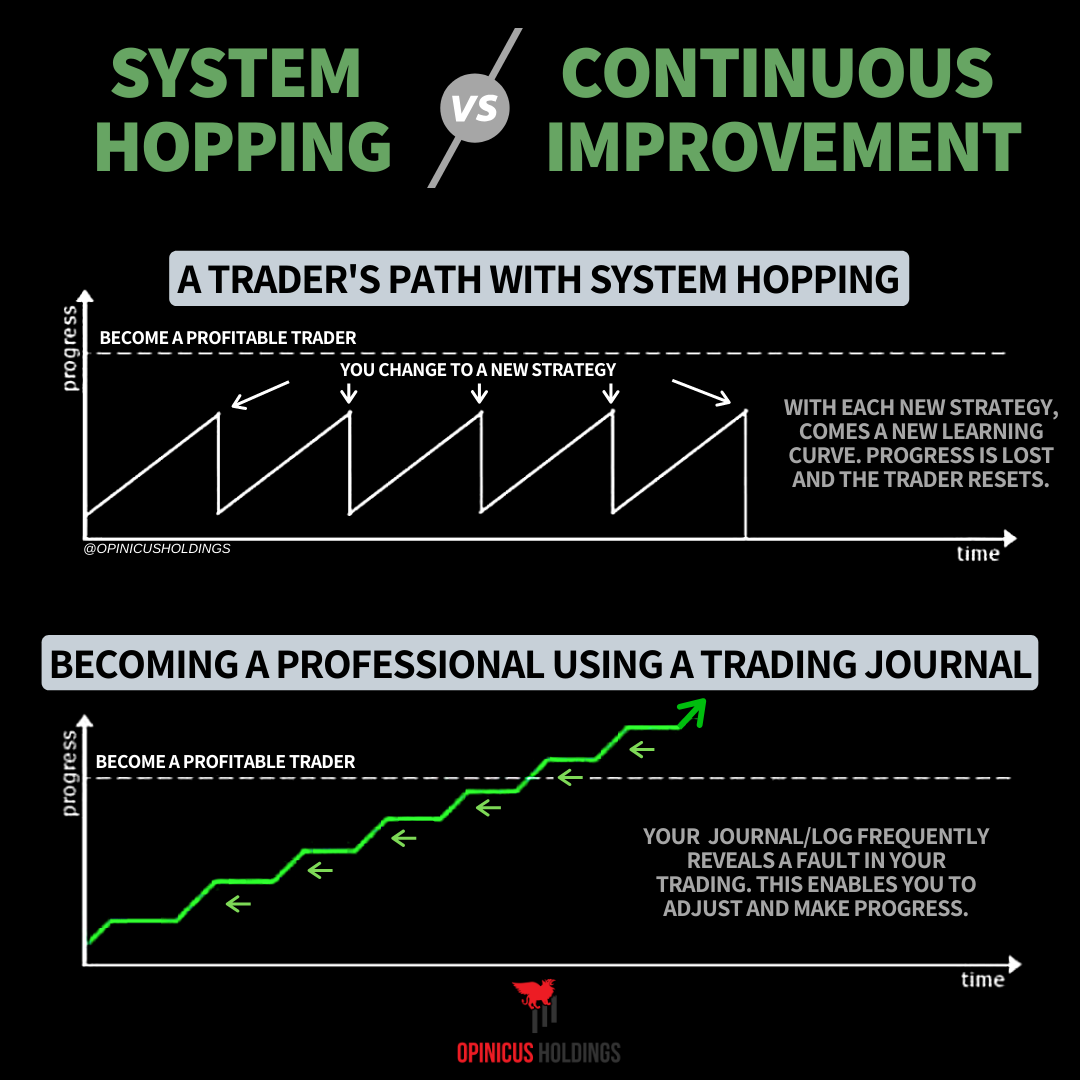

To excel in trading, you must strive to understand every intricate detail of your setups. This includes knowing the optimal conditions for their effectiveness, as well as their limitations. Expertise in identifying which markets and timeframes to utilize, improving odds, setting stops and targets, managing trades, and making strategic decisions will set you apart. The best way to do this is through creating a Trading Playbook. The key lies in consistency and unwavering commitment to your chosen approach, avoiding the temptation to constantly change your strategies.

System Hopping Versus Continuous Improvement

Embracing Losses as Part of Doing Business

The adage that losses are a part of trading is a sentiment we often hear, yet it may seem cliché. However, it's crucial to reexamine its true meaning. Every business incurs costs, but wise expenditures are those that yield a return on investment. Similarly, losses in trading should be viewed through a discerning lens.

When losses occur due to disregarding your own rules or lacking a well-defined approach, they cannot be considered an integral part of your trading business. It's essential to differentiate between avoidable losses caused by personal errors and losses incurred despite adhering to your rules and strategies. Only the latter can be deemed tolerable and inherent to the nature of trading.

Trading for the Long Term

Many aspire to become full-time traders and sustain their livelihood through trading. However, it's important to avoid falling into the trap of trading as if tomorrow heralds retirement. New traders say they want to trade for a living but their actions in the market sometimes suggest they are trying to retire tomorrow. Successful businesses are built on long-term visions, dedication, and a self-determined lifestyle. Traders, too, must adopt a long-term perspective and comprehend the implications it entails:

Recognize the insignificance of individual trades in the grand scheme of things, and refrain from fixating on single events.

Focus on low-risk gains rather than striving for spectacular annual returns. Consistent, modest profits are the foundation of a sustainable trading career. I like to call this the “base-hit mentality.”

Patience is paramount. Acquiring expertise takes time and commitment, and it's worth the investment even if it takes several years to become consistently profitable. By the way, you should be prepared to invest at least a few years of your time to learning to trade. Proper education and guidance can help to speed up the learning curve.

Emulating the Professionals

A powerful concept applicable not only to trading but also to various aspects of life is asking yourself, "What would the pro do?" Professionals at the pinnacle of their field approach their craft with discipline, organization, and conscientiousness. Embracing the pro mindset requires abandoning self-sabotaging behaviors like adding to losing trades, widening stop losses, chasing prices, or heeding unqualified advice. One of the best ways to understand how professional traders operate is to put yourself in the same room as them. The easiest way to do that is to join us in the Trader’s Thinktank.

By consciously considering the actions of experts in your decision-making process, you gradually develop a mindset that propels you toward better outcomes and greater profitability.

Cultivating a Dedicated Trading Environment

A clean and organized work environment can significantly enhance your trading productivity and signal your commitment to trading as a serious endeavor. If possible, designate a specific area in your home as your "trading office" solely dedicated to trading-related activities. Minimize distractions, such as social media or entertainment platforms, and immerse yourself in the trading process. It should go without saying but do not trade from your cell phone.

Adhering to a Well-Defined Plan

Just as businesses operate with strategic plans, traders must have a plan in place before commencing their trading activities. Avoid being merely reactive by outlining your goals, objectives, and preferred trading scenarios. Spend time analyzing your setups and strategies, creating trading ideas, and leveraging tools like price alerts to stay informed. If you are unsure about how to create a trade plan, click here to read more.

Maintaining a comprehensive trading journal allows you to reflect on your adherence to the plan, identify areas of improvement, and learn from both successes and setbacks. Just like successful businesses, consistently evaluating your performance and making necessary adjustments are vital to sustained growth.

Finding Purpose: Your "Why"

Every business has a mission and a purpose driving its existence. Similarly, as a trader, it's important to dig deeper into your motivations. Beyond the surface-level desire for material wealth and luxuries, explore why trading resonates with you on a personal level. Is it to spend more time with your family, pursue your passions, or gain a deeper understanding of financial markets?

Having a clear understanding of your purpose aligns your trading journey with your overall life choices, fueling your motivation and resilience in the face of challenges.

Conclusion

To truly succeed in trading, adopting a business mindset is pivotal. Treating your setups as products and services, acknowledging losses as costs of doing business, embracing a long-term perspective, emulating professionals, maintaining a dedicated trading environment, adhering to a plan, and finding your unique "why" are all critical components of a successful trading business. So, take your trading to the next level by incorporating these principles into your approach and unlock the potential for sustained profitability.