How to Get A Funded Trading Account With Topstep

If you're reading this, then you are either trading with a prop firm, or trying to trade with a prop firm. And if you aren't, don't worry this applies to any trader. One of the biggest challenges that traders have (whether at a prop firm or just trading their own account) is managing risk. I know it's what everyone says, but I also know (through coaching hundreds of traders) it's what everyone doesn't do. Even if it's just one trade that you slip up on, it still happens, and it hurts. Whether it's taking a big hit on a trade or missing the big win because you weren't doing what you were supposed to be doing.

If you're a new, developing, or even experienced trader looking to gain access to funding, you've likely come across the Topstep funded trading program. Their platform offers traders the opportunity to trade with real capital without risking their own funds. It’s a program that I have personally passed through, and have helped multiple clients pass through the combine and get a funded account as well. In this article, we'll dive into the key aspects of the Topstep funding program and how you can maximize your chances of success.

Overview of the Topstep Funding Program

The Topstep funding program is designed to bridge the gap between trading talent and financial backing. It provides traders with a real trading account and a defined set of rules to follow. The goal is to prove your trading skills by demonstrating consistent profitability and effective risk management. Once you meet the program's requirements, you can earn a funded trading account and keep the lion’s share of the profits. That said, you can’t gamble your way through the program. Because the risk parameters are fairly tight, you’ll need a real trading strategy.

Easy Money Trade strategies

Two strategies that I personally used to pass the Topstep combine are what I call the Pullback to VWAP and the 2 Minute Opening Range Break. Both of these are strategies that I personally used when I was primarily an options trader. I’ll briefly detail these strategies below, but if you want an in-depth understanding of the trades, sign up for the Options Mastery Course (despite the name, these strategies apply to futures as well).

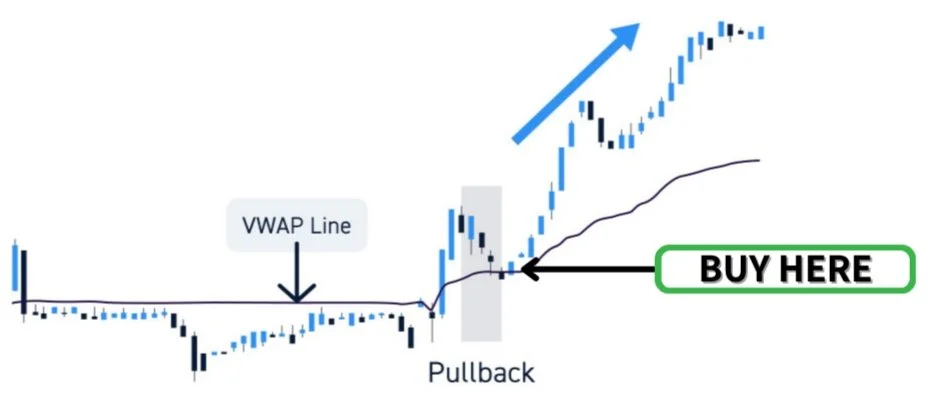

Pullback to VWAP strategy

This strategy involves waiting for a strong trending stock to temporarily pull back to its Volume Weighted Average Price (VWAP) before resuming its trend. This pullback often presents a favorable entry point, as it aligns with the stock's overall direction.

This play works particularly well on the index - Specifically ES and NQ.

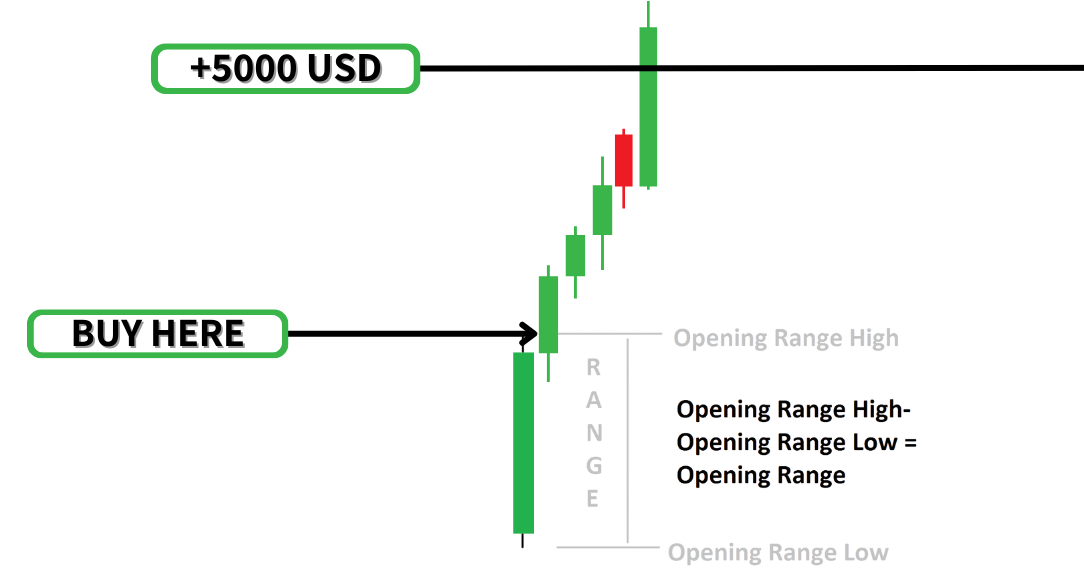

2 Minute Opening Range Break (ORB) Strategy

In this approach, you observe the price movement during the first two minutes of the trading day. Once the price breaks above or below the initial range, you can take a position in the direction of the breakout, anticipating a continuation of the trend.

Managing Drawdown Limit: The Key to Passing the Topstep Trading Combine

A critical aspect of succeeding in the Topstep program is managing your drawdown limit. Many traders mistakenly assume they are “managing” the account balance that they choose - Whether it be $50k, $100k, or $150k. This is incorrect - The ONLY thing you are managing in a funded account is the drawdown limit. This refers to the maximum amount your account balance is allowed to decrease from its highest point. Effective risk management, position sizing, and adhering to your trading strategy can help you stay within this limit and showcase your ability to handle losses responsibly. The main issue traders face when doing these trading combines and challenge accounts is they oversize. For example, on the $100k account, you have the freedom to trade up to 10 contracts. That does not necessarily mean you should be trading 10 contracts at a time - The drawdown limit is very easy to hit when trading max size in the challenge accounts.

The Power of Trading Communities

Trading can be a solitary endeavor, but joining a trading community can significantly enhance your chances of success. Interacting with fellow traders, sharing insights, and receiving feedback can help you refine your strategies, stay motivated, and navigate the ups and downs of the market with greater confidence. Plus, it can be extremely beneficial to lean on the analysis of more experienced traders. Developing traders have a ton of blind spots - You don’t know what you don’t know - And by uncovering those blindspots, you stand to massively improve your consistency and thus profitability. If you are an active trader, or someone who is looking to pass through a funding challenge, join our team in the Trader’s Thinktank. Click here for a 14-day trial.

Staying Ahead: Continuous Learning and Adaptation

To thrive in the world of trading, one must remain adaptable. Markets evolve, and strategies that worked yesterday might not work today. Continuously educate yourself about new trading techniques, stay updated on market trends, and be open to adjusting your approach as needed. If you are approaching a funding challenge without a well-defined strategy in mind, your chances of passing are slim. Use one of the setups mentioned in this article, and for a more in-depth education, check out the Trading Mentorship Group (we meet weekly) or the Options Mastery Course.

In conclusion, securing a funded trading account with Topstep requires a combination of strategic trading, disciplined risk management, and a willingness to learn. By mastering easy money trades, respecting drawdown limits, and tapping into the power of trading communities like the Trader’s Thinktank, you can increase your likelihood of achieving success in the exciting world of trading.