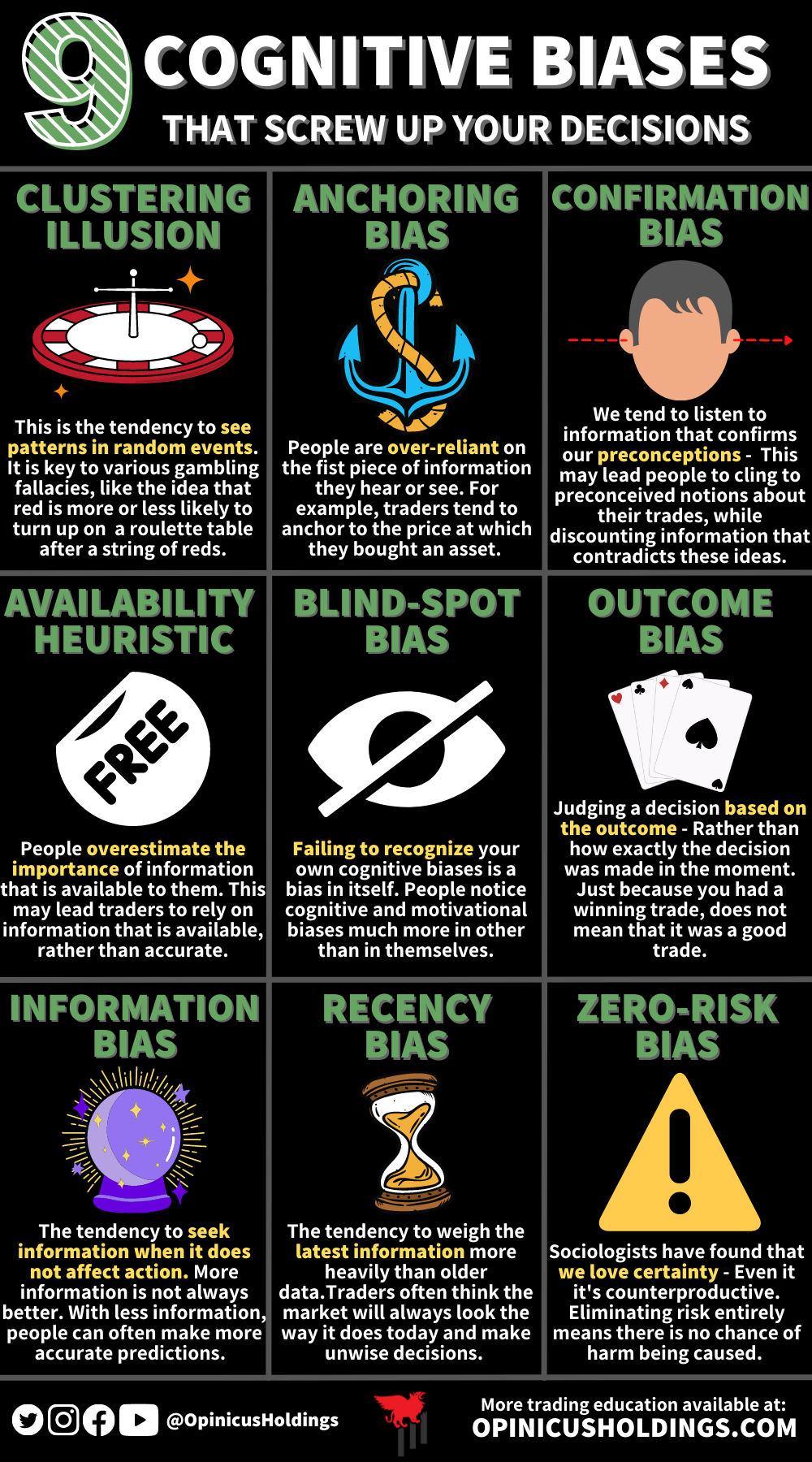

9 Cognitive Biases That Screw Up Your Trading Decisions

Clustering Illusion

This is the tendency to see patterns in random events. It is key to various gambling fallacies, like the idea that red is more or less likely to turn up on a roulette table after a string of reds.

Anchoring Bias

People are over-reliant on the first piece of information they hear or see. For example, traders tend to anchor to the price at which they bought an asset.

Confirmation Bias

We tend to listen to information that confirms our preconceptions - This may lead people to cling to preconceived notions about their trades while discounting information that contradicts these ideas.

Availability Heuristic

People overestimate the importance of information that is available to them. This may lead traders to rely on information that is available, rather than accurate.

Blind-Spot Bias

Failing to recognize your own cognitive biases is a bias in itself. People notice cognitive and motivational biases much more in others than in themselves.

Outcome Bias

Judging a decision based on the outcome - Rather than how exactly the decision was made in the moment. Just because you had a winning trade, does not mean that it was a good trade.

Information Bias

The tendency to seek information when it does not affect action. More information is not always better. With less information, people can often make more accurate predictions.

Recency Bias

The tendency to weigh the latest information more heavily than older data. Traders often think the market will always look the way it does today and make unwise decisions.

Zero-Risk Bias

Sociologists have found that we love certainty - Even if it's counterproductive. Eliminating risk entirely means there is no chance of harm being caused.

To learn more about overcoming the psychological challenges that plague most developing traders, check out our Options Mastery Course.