7 Effective Trading Techniques for Stocks and Futures

Intraday trading can be a rewarding venture in options and futures markets. For newcomers and developing day traders, mastering the right techniques is essential. This comprehensive guide will explore seven effective intraday trading techniques that can significantly enhance your day trading strategy.

Understand Market Behavior

Not all markets behave the same way. It's crucial to discern whether the stocks or futures you are trading have a trending or mean-reverting behavior. This understanding will serve as the foundation for your intraday trading strategies. As a general rule of thumb, individual stocks are more prone to trend, while indices are more prone to be mean reverting.

Market Behavior Insights:

Recognizing trending and mean-reverting markets.

Adapting your strategies to market behavior.

Identifying ideal trading opportunities within different market types.

Gauge Market Exhaustion

Understanding when a market is nearing exhaustion is a vital risk management skill. Monitoring indicators like the Average True Range (ATR) can help you assess historical volatility and identify exhaustion points. One of the best ways to gauge where a market may see a turning point is to have a strong understanding of market structure. This is especially important if you trade the index.

Gauging Market Exhaustion:

Utilizing the Average True Range (ATR) indicator.

Defining exhaustion points and risk tolerance using market structure

Adapting your trading approach during periods of market exhaustion.

Identify Key Turning Points

Flexibility is key in intraday trading. Regularly revisiting and adjusting support and resistance levels is a valuable technique. Pay special attention to the previous week's high and low points, which often act as significant turning points. Once again, market structure plays a big role in identifying these key turning points.

Identifying Key Turning Points:

Importance of dynamic support and resistance levels.

Incorporating the previous week's high and low into your strategy.

Utilizing tools and indicators for precision.

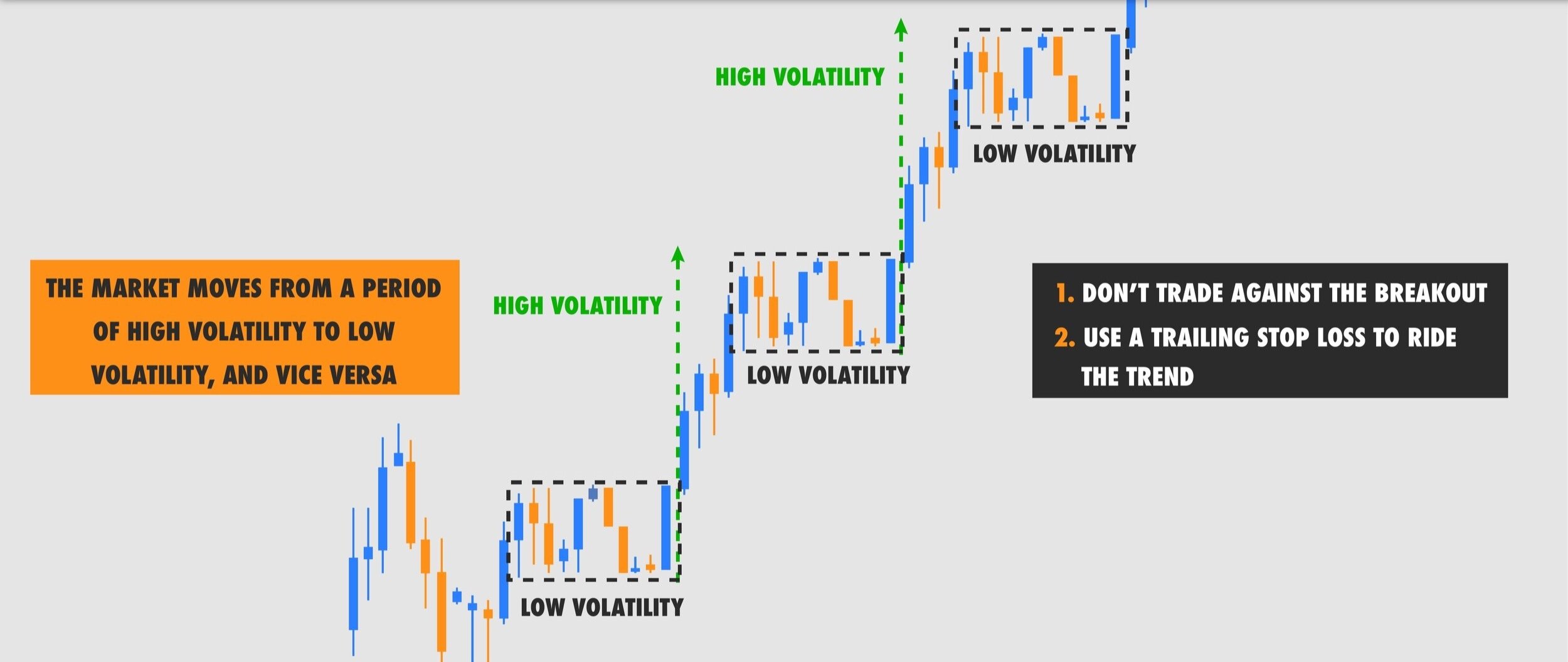

Anticipate Market Volatility

Market volatility is dynamic and impacts all trading strategies. Recognizing periods of low volatility and understanding their significance can help you prepare for potential shifts in market behavior. To gauge current volatility, make sure you are looking at the higher timeframe daily and weekly charts and using multiple timeframe analyses to your advantage. If the market is trading in a tighter range, it is a good sign that you should stay nimble and take quicker profits.

Anticipating Market Volatility:

Identifying periods of low volatility.

Adapting profit targets and risk management strategies.

Preparing for market shifts during low volatility phases.

Trade During High-Volatility Hours

Choosing the right trading hours can significantly impact your intraday trading success. Some trading times, like the first 90 minutes of the day, offer higher volatility, providing more trading opportunities. Personally, I like to “chunk” my trading day into different parts - Each part has a specific approach that is based on the years of performance data that I have collected.

Trading During High-Volatility Hours:

Leveraging the most profitable trading hours.

Tailoring your strategy to match market behavior during specific times of day.

Chunk your trading day into different parts to improve performance.

Be Mindful of Major News Releases

Staying informed about upcoming news releases is essential to protect your trades from unpredictable market swings. Exiting positions before significant news releases and managing your stop-loss levels are crucial tactics. You want to watch out for things like FOMC, earnings, economic data releases (usually premarket), and the like.

Being Mindful of Major News Releases:

The impact of news on market liquidity and spreads.

Developing a news release calendar.

Strategies to mitigate risk during major news events.

Leverage Support and Resistance

Support and resistance levels are the basis of every technical trader’s arsenal. They play a crucial role in identifying intraday trading opportunities. By waiting for the price to approach key levels on higher timeframes and monitoring lower timeframe structure, you can make well-informed trade entries. If you have an understanding of market structure and multiple timeframe analysis, you can build a profitable trading strategy.

Leveraging Support and Resistance:

Identifying support and resistance levels on different timeframes - Multiple Timeframe Analysis.

Recognizing breakouts and reversals.

Strategies for maximizing profits using support and resistance.

Conclusion

Intraday trading in stocks and futures demands a disciplined and informed approach. By mastering these seven intraday trading techniques—understanding market behavior, gauging market exhaustion, identifying key turning points, anticipating market volatility, trading during high-volatility hours, being mindful of major news releases, and leveraging support and resistance—you'll be better equipped to navigate the fast-paced world of intraday trading. These techniques, combined with practice and dedication, will help you build a solid foundation for your day trading journey, ultimately increasing your chances of success in the markets. IF you need help applying these techniques and creating a trading system that suits your personality, check out our trading mentorship programs.