The Trading Journey: Managing Expectations

In the world of trading, it's easy to fall into the trap of expecting immediate success and instant profits. Many developing traders approach the markets with the belief that their energy should be immediately rewarded with substantial profits. This belief is amplified in today’s day and age, with many skilled traders sharing their profit screenshots via social media. However, this mentality is flawed and can lead to frustration, impulsive decisions, and ultimately, setbacks in their trading journey.

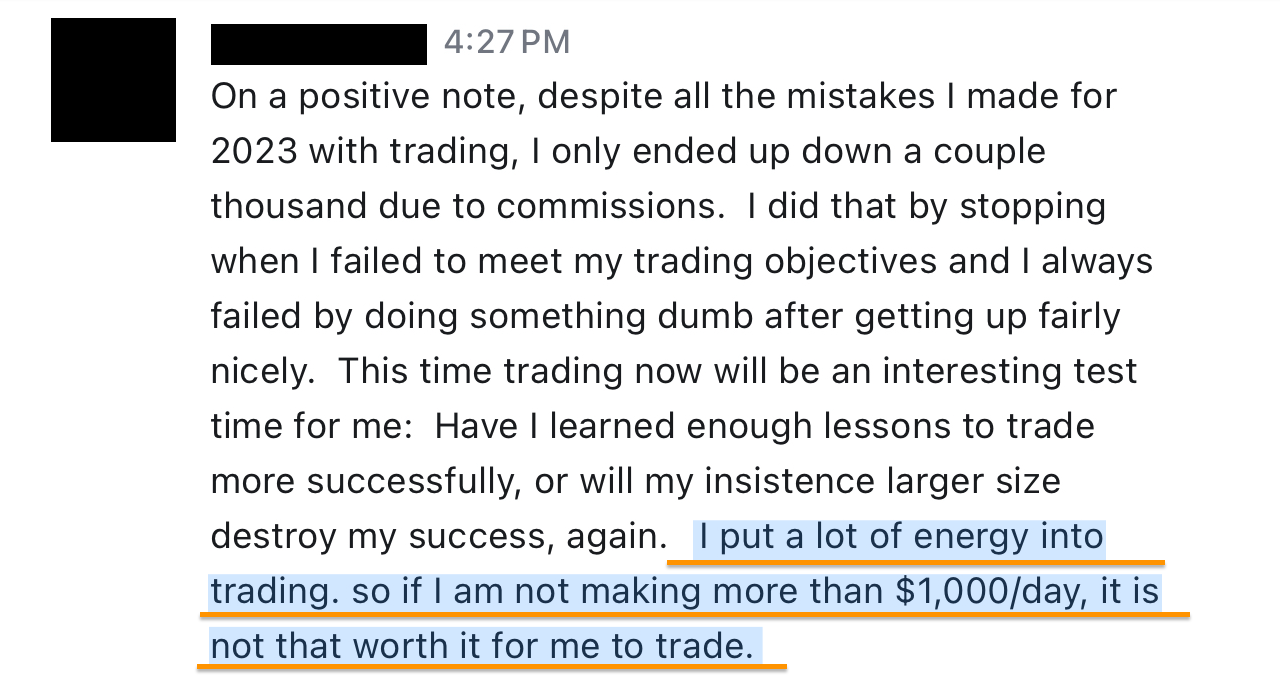

A recent message that I received from a trader highlighted this common misconception.

A common, yet highly flawed mentality that developing traders have when they approach the markets

This mindset is not unique to this trader; it's a common pitfall among many developing traders. They often compare trading to other high-paying professions like medicine or law, forgetting that just as doctors and lawyers undergo years of education and training before they can practice independently, traders must also invest in their education and experience before they can expect consistent profits.

The learning curve in trading can be steep, and mistakes - sometimes costly - are often part of the process. Every mistake is an opportunity to learn and improve, but it's crucial to approach trading with a mindset of continuous improvement rather than expecting “quick and easy” profits. Just as a doctor learns from each patient they treat and a lawyer learns from each case they handle, a trader learns from each trade they make.

Setting unrealistic profit expectations can lead to emotional decision-making and excessive risk-taking. Instead, traders should focus on developing a solid trading plan, managing risk effectively, and continuously honing their skills. Like I frequently say to 1-on-1 clients, profits in trading are only a byproduct of a strong process. The goal for a developing trader should be around following processes and respecting their trading rules, rather than certain daily profit goals. Consistency and discipline are key; success in trading often comes from sticking to a well-thought-out strategy over the long term, rather than seeking quick wins.

In conclusion, many market participants come to the market for quick profits - These people should not be referred to as traders, but rather gamblers. Many people talk about the “high failure rate” that trading has, but if this is how some market participants treat the market, is it any surprise? Real trading is a journey that requires patience, perseverance, and a willingness to learn from mistakes. Developing traders should view their energy spent in the markets as productive, focusing on improving their skills and learning the craft. By managing their expectations and adopting a mindset of continuous improvement, traders can increase their chances of true consistent profitability.