The Power of Emotions in Trading: Understanding Regret and Risk

Emotions often drive investment decisions, and the world of trading is no exception. Fear and greed have long been recognized as powerful influencers that lead individuals to buy and sell assets at precisely the wrong moments. Likewise, behavioral economists have delved into the psychology of traders, highlighting how the fear of regret can significantly impact decision-making.

The Power of Regret

The interplay between emotions and risk-taking keeps many traders second-guessing their choices. When confidence in a trade's success runs high, execution is swift, but uncertainty can lead to hesitation, causing traders to miss out on profitable market moves. The challenge in trading lies in accurately assessing risk, managing emotions, and executing trades with calm rationality. Unfortunately, overconfident traders often struggle to gauge their emotions accurately.

The Challenge of Trading

A study conducted by Karin Tochkov and Edelgard Wulfert at the University at Albany, SUNY, sheds light on the inability of some individuals to anticipate their emotional responses after a financial loss. The study unfolded in two phases. In the initial phase, university students were asked to imagine making a gamble and rate how disappointed they would feel in the event of a loss, such as, "How would you feel if you lost $150?" A week later, in the second phase, they returned to the lab to actually engage in the gamble, experiencing the real emotional consequences of losing money. Astonishingly, frequent gamblers consistently misjudged their emotional reactions, underestimating their feelings of disappointment compared to non-gamblers. The ability to accurately foresee emotional responses after a real financial loss was linked to risk aversion. This is one of the main concepts that holds traders back on their path to profitability.

Research Insights: Anticipating Emotional Responses

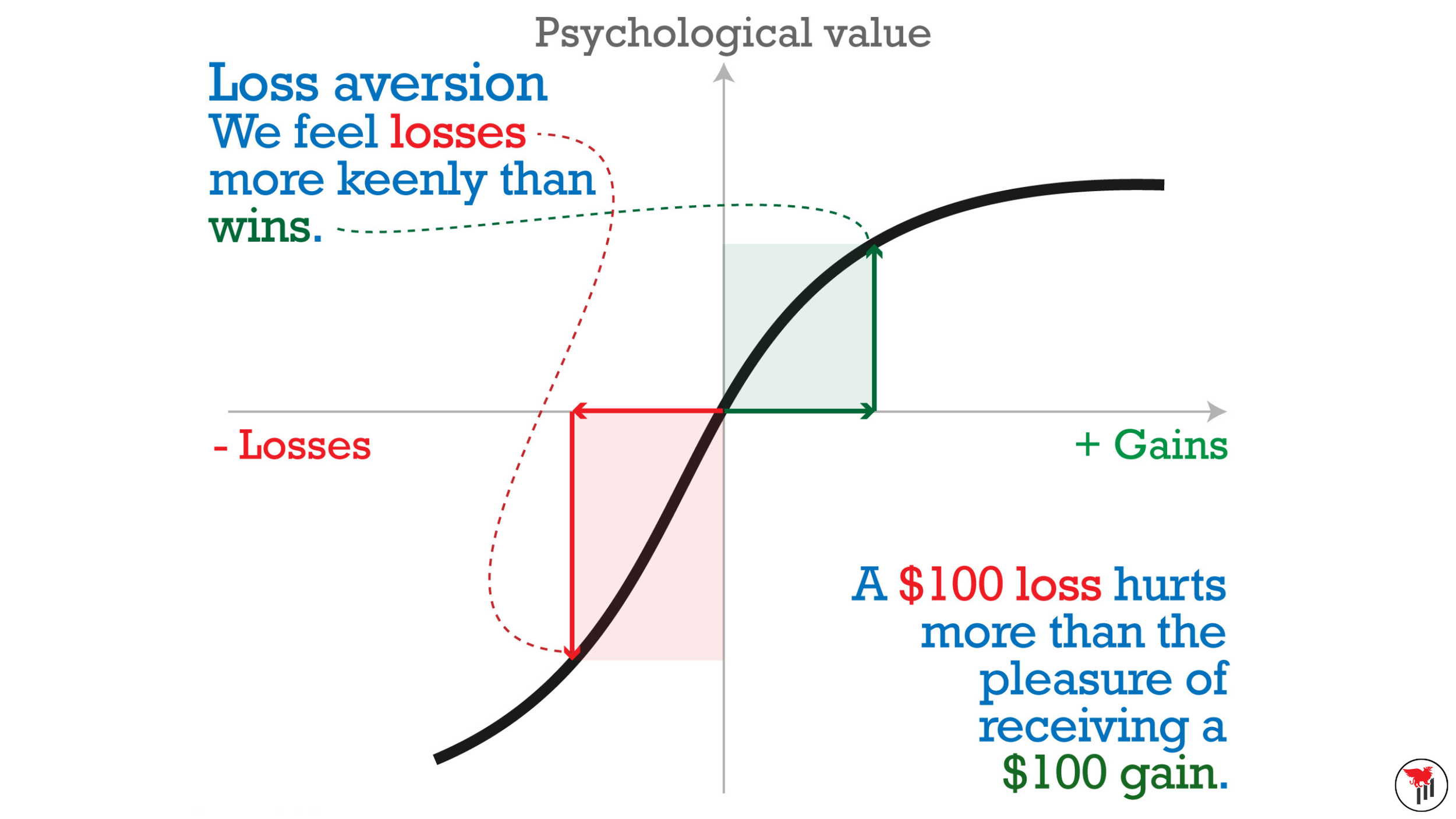

These findings suggest that overconfidence and over-trading may result from an inability to accurately anticipate the emotional aftermath of financial losses. Overconfident traders often underestimate the emotional impact of losses, leading them to take excessive risks. Conversely, traders who hesitate before executing a trade often anticipate the emotional consequences of a loss as more severe than they actually turn out to be. This avoidance of regret serves a protective function; envisioning the discomfort of a loss makes traders reluctant to take unnecessary risks.

In the 5+ years I have been working one-on-one with traders, and through almost a decade of my own personal trading - I can attest that these findings are accurate. Developing traders must work to fully internalize and accept the risk of every trade - Including the chance of taking a full stop. If you can reach this point, it’s a sign that you are on the right path and very close to consistent profitability.

The Pitfalls of Overconfidence

If you find yourself making excessive risky trades and facing the consequences, it might be worthwhile to shift your focus to the emotional aspect of losing. Perhaps you haven't fully considered the potential negative consequences of a loss. This is a topic we frequently discuss in the Trading Mentorship Group. By concentrating on how you'll feel after a loss, you're more likely to pause and thoroughly evaluate your trading decisions, ultimately managing risk better and waiting for high-probability setups instead of impulsively engaging in detrimental trades. While emotions can sometimes interfere with rational execution in trading, consciously acknowledging the potential emotional toll of a loss can serve as a powerful deterrent, preventing impulsive trades that could lead to devastating account losses.