Tanner Owings: One-on-One Trading Mentorship Client Case Study

Who is TheStrongTrader?

Tanner has accomplished a huge amount within the 6 years since he began working with Opinicus, and continues to rise both in his profitability and maturity as a trader. From knowing next to nothing about what it takes to be a day trader, to developing consistent profitability, quitting his job, and trading for full-time income with regular 4-figure days. Now, even helping some beginner traders with their journey and development as well! In this case study, I’ll highlight Tanner’s ascension into the world of profitable trading, and how the service I offer through Opinicus accelerated his journey.

Dates of Interest:

November 26th, 2018 - First day joining swing trade alerts via the Swing Trade Radar

May 6th, 2019 - First day trading in the Trader’s Thinktank

May 11th, 2019 - Signed up for the Options Mastery Course

Oct 21st, 2019 - First day of full-time trading

May 16th, 2021 - Signed up for One-On-One Trading Mentorship

Late 2021, early 2022 - Moved from breakeven / boom-bust phase to consistent profitability after working together to implement tighter process control and stronger strategies

November 2022 - Renewed One-On-One Trading Mentorship

2022-2023 - Worked together to eliminate overtrading and outlier-loss-days which were negatively impacting the equity curve and psychology

2023 - Regular 4-figure trading days, received over $1M in funding through Topstep and other prop firms

2023-current - Transitioned from the one-on-one mentorship program to the trading mentorship group to continue to refine skillset in futures trading

Tanner’s Background & Engagement with Opinicus

Prior to Opinicus, Tanner’s experience in trading was quite limited. He originally found Opinicus through Instagram, while working a typical 9-5 job post-college. One of his first introductions to the power of options was through our live-stream trade alert service. After some quick account growth, and seeing what was truly possible -Tanner was hooked. If this sounds familiar, it is because most traders have a similar origin story.

Feeling inspired and seeing the possibility of an exit from the typical 9-5 rat race, Tanner decided he wanted to engage in the market more actively and learn the ropes on his own. Around early May, just 6 months after signing up for the alert service, Tanner joined the team in the Trader’s Thinktank and purchased the Options Mastery Course (OMC). Through the OMC, Tanner learned trading strategies that helped him develop a foundation for his trading career. It was not long after this point that he was able to quit his job and pursue trading in a full-time capacity. However, going full-time presents an entirely new suite of challenges.

Initial Performance Analysis

7 months after quitting his job and going full-time, Tanner reached out for one-on-one mentorship. I had been trading alongside him in the Traders Thinktank on a daily basis - He was posting some strong trading days. It was clear he knew how to make money in the market. The problem that most developing traders have is not with making money. Making money in the stock market is not necessarily that difficult. The challenge really comes with keeping the money that is made. This is often called the “boom and bust” phase of a trader’s development and usually amounts to breakeven results. For example, it was not uncommon to see Tanner have a nice string of profitable days, just to give back all of that progress in a single day from one or multiple missteps. This is a challenging phase for traders to break out of because as a developing trader, you don’t know what you don’t know. Traders in this phase often think they are missing something, and so they add to their analysis and process, in hopes that it pushes them out of the boom and bust phase and into consistent profitability. Unfortunately, this approach only compounds the issue and creates more noise for the trader.

Tanner recognized that he was close to the consistent profitability that eludes most, and set up a consultation call for trading mentorship. After speaking with him at length about his trading, it was clear he had a decent edge through trading a few of the strategies detailed in the OMC. His mindset was strong, he was not here to get rich quickly, and his profile matched that of clients I had helped in the past - I was confident that with some much-needed guidance, he could advance from that boom and bust phase.

Coaching Journey

Trading Playbook Creation and Development

With any clients that have prior trading experience, one of the first things to do is to develop a trading playbook. As a mentor and trader’s coach, it’s important to understand the components and details of the clients’ strategy, and this is where the playbook comes in. It’s not enough to say “I trade momentum breakouts” - This is a broad term that quite frankly means very little when it comes to trading strategies. Many traders wrongfully assume that categorizing trades in this manner is enough detail. We need precise details: What does the structure look like? What does volume look like? What stocks/index? Time of day? The list goes on and on. Unsurprisingly, this exercise alone has a massive positive impact on clients as it forces them to look at the specifics of their strategy, and oftentimes, it shows them that many of the setups they were taking are not within their wheelhouse. The devil is in the details, and in trading, nuance makes all the difference.

In Tanner’s specific case, it was no different. At the time, he gravitated toward momentum trades involving options. Specifically, opening-drive trades in stocks in play. This setup was one of my personal specialties - Attention to detail is incredibly important in this trade. Tanner and I worked together to define the parameters that would define this setup as A+, documented the parameters in a playbook, and were able to make sure his trades adhered to this framework. This early effort generated almost instantaneous results, as it usually does. Just two months after signing up for the One-On-One Mentorship, Tanner posted his largest trading day ever on July 21st, 2021 in a momentum play on ticker CMG.

Our work together began to pay off quickly. Tanner recognized the importance of tightening up his processes and paying more attention to the details. He mentioned, "So Juiced on this Playbook thing still. To be dead honest I didn’t reference my playbook enough. It was there but between having it on Word, Tradervue for logging, handwritten notes, handwritten journal, etc... everything was just so scattered. This helped consolidate so much of it. I have a good feeling that going over my playbook every morning will help reinforce my process and mindset so much more. It’s gonna be the main thing I look at EVERY day. just like you said in the video you reference it every day." Plus, the added psychological benefit of having an accountability partner - Someone you know you’ll have to share your trades with - Can make all the difference when you are live trading.

Trading Journaling and Review

Once the playbook is developed and usable, journaling and trade review become a big aspect of a trader’s development. While the two terms - Trade journaling and review - Are often intermixed, they are two very different things. Trade review is more focused on the specifics of the trade itself: Entry, exit, trade management, quality of the idea, time of day, etc. It is an objective look at how you as the trader interacted with price. Journaling on the other hand, is more of a personal reflection. It is an introspective look at your behaviors and emotions throughout the trading day. Did something in price trigger a fearful reaction? Greed? Anger? A journal is a good place to unpack those emotions.

Both of these tools are nonnegotiable when I am working with a client. These tools help us cross-reference actual trading behaviors versus our playbook, and uncover any emotions that are leading to poor trading behaviors. With an athletic background in competitive powerlifting, Tanner was no stranger to the review process, and I attribute a big part of his trading success to his willingness to look in the mirror and dive deep. Through this process, we were able to identify a few key details in trading setups that were being overlooked, as well as some behaviors that were not serving the long-term focus. As an example, through this process, we were able to uncover that some of Tanner’s worst-performing plays were those gaps higher that did not actually trigger an entry. Through journaling, we found that the sight of a gap in a stock triggered an over-eagerness to get involved, and through trade review, we found that these ideas were not triggering an entry per the strategy.

This is the purpose and value of trade journaling and review - It helps you uncover setups, behaviors, emotions, etc that are not serving your bottom line. It is a tool for uncovering issues and finding holes in your process. Once those holes are found, a fix can be developed through new rules and frameworks.

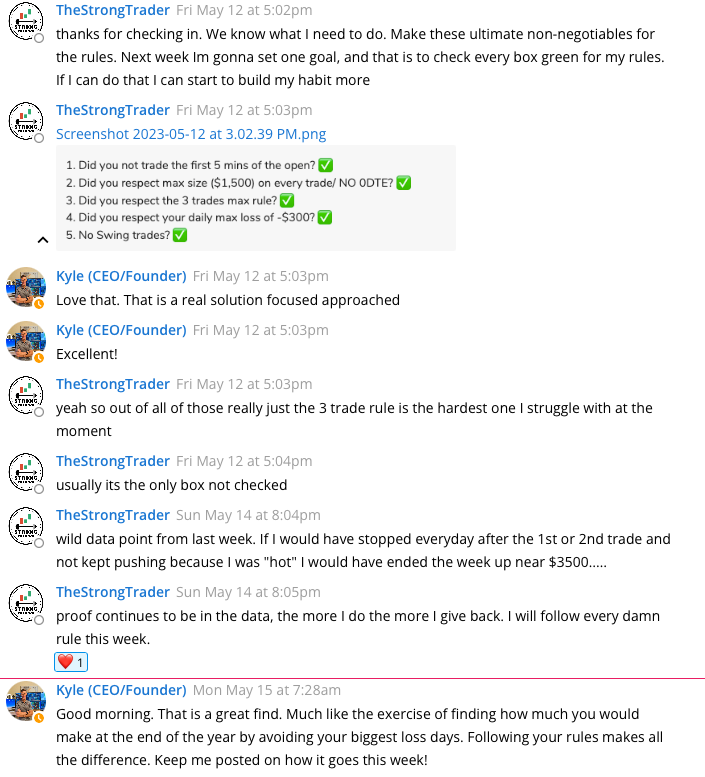

Trading Rules

Trading rules are paramount to any trader’s continued success. They are designed to protect us from ourselves and offer a framework we can operate within. I think of them as guardrails or bumpers in a bowling lane. While I won’t disclose all of them here, one of the higher-impact rules we deployed in Tanner’s process was to eliminate trading the open. Specifically, what we found through the review process was that a majority of Tanner’s outsized losses came from entries taken within the first 5 minutes of the session. A powerful exercise that can be done is to see how much additional profit you would have kept with a simple rule. In this case, when I suggested Tanner look back and see how much trading the open was really costing him - He found that tens of thousands of dollars in additional profit would have been added to the bottom line had this rule been implemented earlier! When you see figures like that, it becomes much easier to implement a rule. Suffice to say Tanner stopped trading the first 5 minutes of the session, and not only did his profitability improve, but his mindset did as well.

An exchange with Tanner about trading rules

Many developing traders view trading rules negatively - Like they are restrictions that will not allow them to maximize their profitability. While I have had this discussion with many clients before, Tanner was not one of them - He recognized that the restrictions that come from rules are designed to protect you from yourself. They restrict you from your bad habits and behaviors.

Trade Documentation

The next phase of Tanner’s mentorship and coaching was through trade documentation. Trade documentation (also known as playbooking, book of charts or archiving your best setup) is a powerful way for traders to get effective reps without actually placing any trades. The practice is simple: at the end of the trading day, find that easy money setup and annotate the chart with the details of the trade and how you might have played it. Like many trading analogies, the best analogy can be drawn from professional sports - Athletes will often watch game tape to supplement their practice. Tanner was no stranger to this concept and embraced it every single trading day, whether it was a tough or easy session. This willingness to study the charts (even when he did not feel like it) was a key component to his eventual success as a trader.

Performance Transformation

Tanner flips from break-even to consistent profitability

Using the frameworks outlined above, Tanner was able to progress through the boom and bust phase into being a somewhat consistent, and then fully consistent trader with week-over-week and month-over-month profits. Not only that, but he was able to successfully switch his trading from an options-focused approach to an index futures approach. On paper, this transformation was quite simple. While the frameworks are quite easy to apply, it was anything but easy in practice. Progress in trading is not linear. There will be amazing weeks where you feel on top of the world, and weeks where you truly question if it is all worth it. In a single day as a trader, you can navigate the panoply of human emotions. Emotions that many people have never explored before. You’ll find things within you that you did not know you had, both negative and positive. While I was there to help Tanner navigate these emotions and see the light at the end of the tunnel, he was the one who had the grit to persevere when times got tough. I have likely spent 50-100 hours with Tanner through Zoom calls, phone calls, and messaging sessions - But that pales in comparison to the hundreds, if not thousands of hours he has spent studying, memorizing, and applying the discussed frameworks and mental models. In trading and life, a mentor can provide a guiding light and frameworks to use, but the mentee is still required to put in work. Tanner’s willingness to keep going and try new things was inspiring, and he deserves all of the trading success he has now and will continue to see as his journey continues. From an alerts-follower to a full-time, consistent trader (and now being featured in trading podcasts and even helping others on their journey), all developing traders can learn something from Tanner’s journey that has been outlined here. Below are a couple of the many highlights over the past few years. Click to expand any of the below images.

Bigger trading days become the norm for Tanner

Tanner passes Topstep Combine, gains over $500k in funding

Tanner’s Testimonial

Conclusion

Tanner Owings' journey from a novice day trader to achieving consistent profitability and funding is not just a testament to his determination and hard work, but also highlights the effectiveness of targeted, personalized mentorship. Tanner's story exemplifies the profound transformation possible through the comprehensive approach offered by the Opinicus mentorship program. By focusing on critical aspects such as trade documentation, rules implementation, and continuous review, Tanner managed to navigate no only the challenges of the market, but the internal psychological challenges of trading and emerged as a skilled and successful trader. His progression is a powerful demonstration that with the right guidance, discipline, and tools, achieving trading mastery is within reach.

Are you ready to take your trading to the next level, just like Tanner? At Opinicus, we don’t just teach trading; we guide you through a customized journey tailored to your unique trading style and goals. If you’re seeking to break out of the boom-and-bust cycles and step into consistent profitability, our One-On-One Trading Mentorship Program might be the perfect fit for you. Apply for the program today to discuss how we can help transform your trading and accelerate your journey towards becoming a full-time trader. Don’t let another day of potential pass you by.