Mastering Market Openings: Understanding the Opening-Drive Trade

Understanding the different market openings is crucial for intraday traders seeking profitable opportunities. Among the various types of market openings, one stands out as the most forceful and definitive: the Opening-Drive. Let's delve into what the Opening-Drive is, how it impacts trading, and strategies for navigating this momentum play.

What is the Opening-Drive?

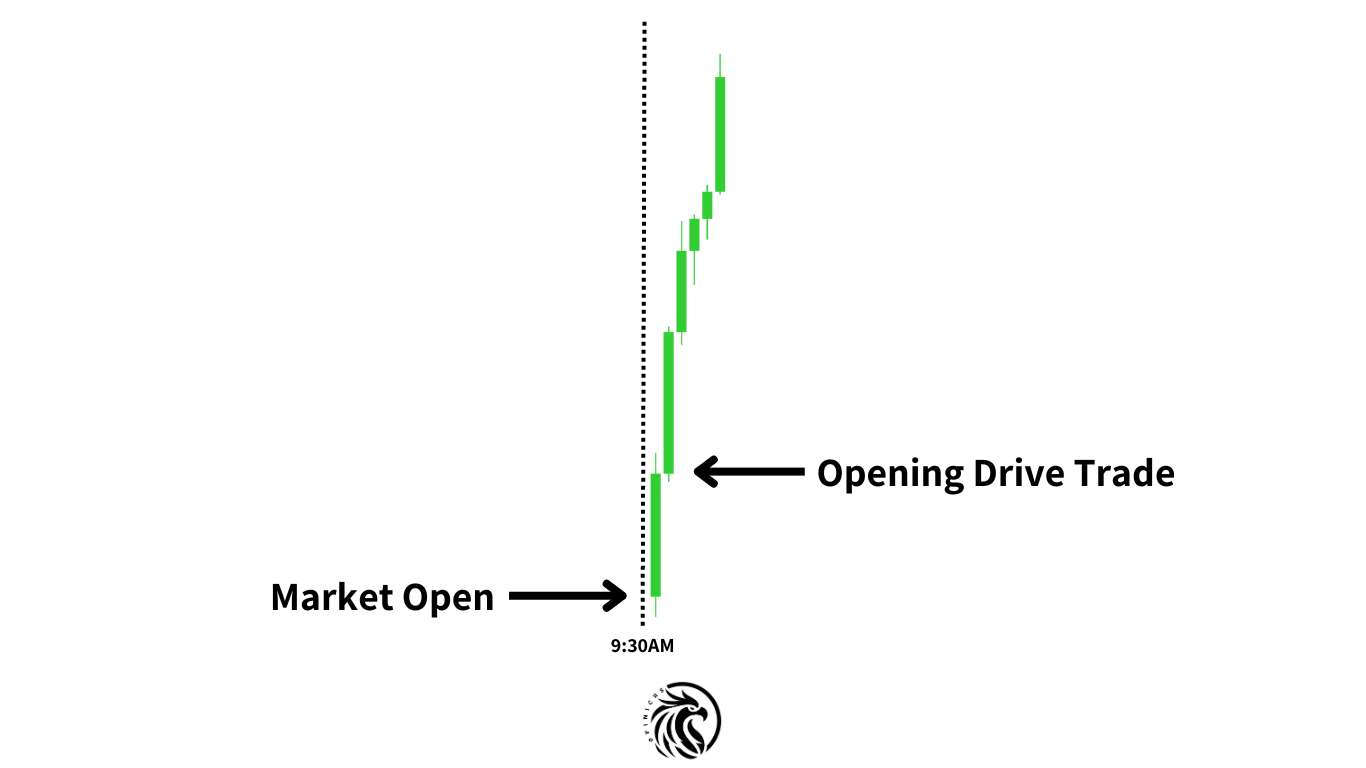

The Open-Drive is characterized by a swift and aggressive market opening, where prices surge in one direction with minimal retracements - A true momentum move. Imagine a racehorse bursting out of the gate with unstoppable momentum, setting the tone for the day's trading activity. This type of market opening provides traders with an early reference point, as opening prices are less likely to be revisited later in the day. This trade is very similar in nature to the Opening Range Breakout (ORB) play. If you are familiar with that setup, you’ll be able to master the Opening-Drive as well.

Visual of the Opening-Drive Trade

Understanding Context

Before delving into strategies for trading the Opening-Drive, it's essential to understand the broader context of market dynamics. Market cognition goes beyond fixed definitions, requiring traders to immerse themselves deeply in market activity and exercise creative thinking. Each market opening must be analyzed within the context of prevailing trends and market sentiment to make informed trading decisions. Certain conditions and big-picture market structure developments will not call for the opening-drive setup to be traded, and in other scenarios, the opening-drive will not develop. Before trading this setup, it would be wise to understand which conditions it works best in.

Strategies for Trading the Opening-Drive

Recognize High-Confidence Scenarios: The Opening-Drive typically signals high confidence in a particular direction. Traders should be prepared to capitalize on this momentum while remaining vigilant for any signs of reversal. Generally speaking, a strong opening-drive trade with the right market context will not only mark the session low but will continue in its directional nature until at least 10 AM reversal time. Note, the opening drive happens in both the index and Stocks in Play.

Consider Contextual Factors: Analyze the broader market context, including the previous day's trading activity and prevailing trends. This additional perspective can help refine trading strategies and manage risk effectively. What does the big-picture market structure currently show?

Monitor Market Dynamics: Pay close attention to how the market behaves following the Opening-Drive. Look for signs of sustained momentum or diminishing confidence, which may indicate potential opportunities or risks. As mentioned previously, a proper opening drive trade should give continued momentum until at least 10 AM.

Proactive Risk Management: Instead of relying solely on stop-loss orders, aim to exit trades proactively based on market dynamics and changing conditions. This proactive approach can help minimize losses and maximize profits. In the Trader’s Thinktank, we like to scale out of trades as the market proves us correct on the play.

Conclusion

Mastering market openings, particularly the Opening-Drive, requires a combination of technical analysis, market intuition (through experience), and proactive risk management. By understanding the underlying dynamics and context of market movements, traders can capitalize on profitable opportunities while effectively managing risk. Whether you're a seasoned trader or just starting, incorporating the knowledge of these strategies into your trading toolkit can help you navigate the day’s price action and make better decisions. If you need help identifying or mastering this setup, join us in the Trader’s Thinktank or apply for the 1-on-1 trading mentorship.