ICT's Order Blocks: Is This A New Concept?

In technical analysis, understanding the behavior of market participants - namely institutional traders - is key to making informed trading decisions. Among the many concepts designed to capture institutional activity, two stand out for their focus on specific price levels: ICT’s Order Blocks and Steidlmayer’s High Volume Nodes (HVNs). While these concepts are often treated as separate approaches, a closer look reveals that they share fundamental principles, suggesting that ICT’s Order Blocks may have roots in the ideas laid out by Steidlmayer’s Volume Profile analysis.

The Foundation of High Volume Nodes

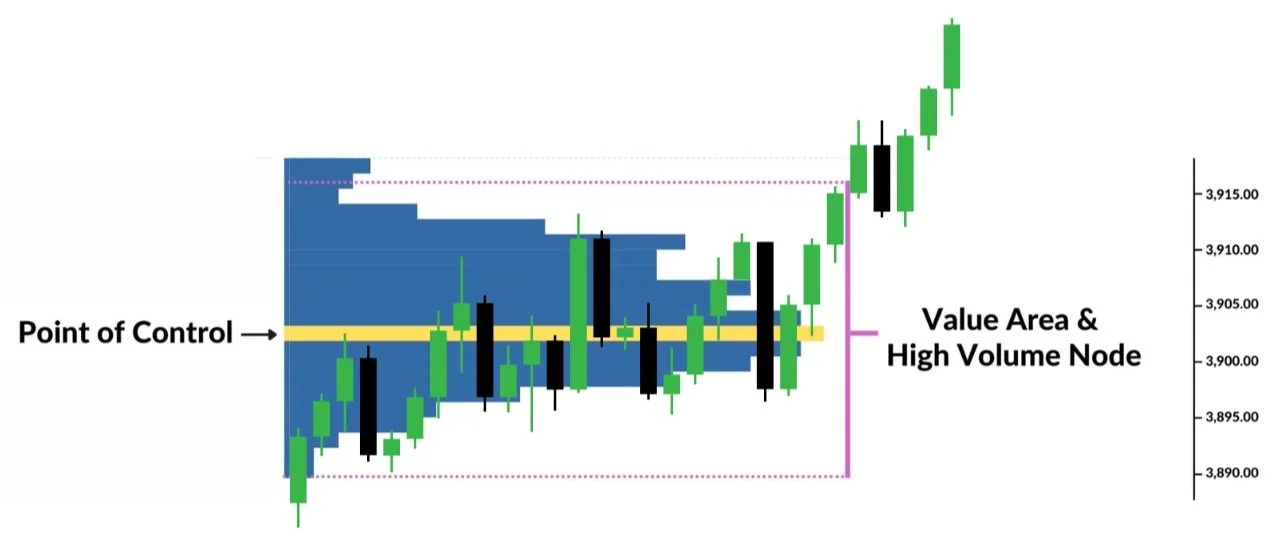

Peter Steidlmayer, a prominent figure in market theory, introduced the Market Profile and Volume Profile concepts to help traders understand the distribution of volume across different price levels. A key component of this analysis is the High Volume Node (HVN):

High Volume Nodes (HVNs): HVNs are price levels where a significant amount of trading volume has occurred. These nodes often represent areas where institutional traders are most active, as their large orders tend to create substantial volume at specific price points. HVNs are typically seen as areas of support or resistance, as price often revisits these levels due to the concentration of trading activity.

The idea behind HVNs is that the market will gravitate towards these high-volume areas because they represent fair value zones where both buyers and sellers have been most active. Understanding where these nodes lie on a price chart can give traders a strategic edge in understanding price movements. It is a tool that we are frequently using and discussing in the Trader’s Thinktank.

ICT’s Order Blocks: A Modern Interpretation

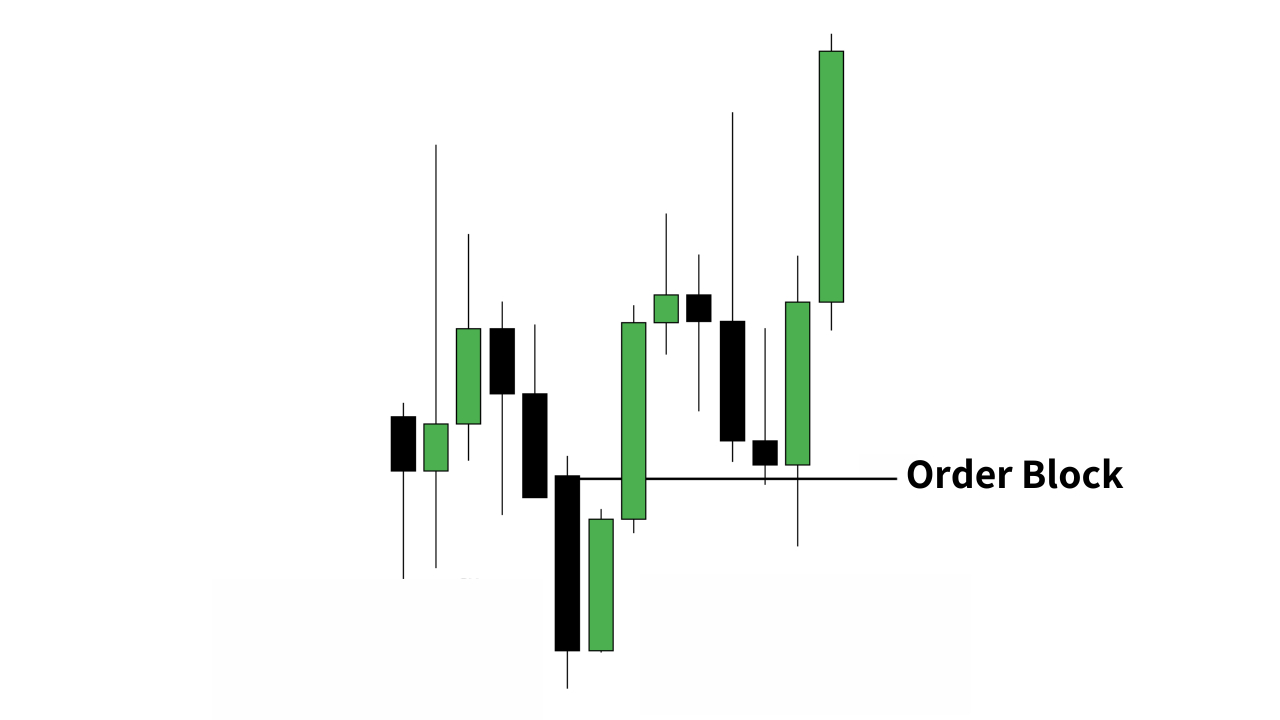

ICT’s Order Blocks are a newer concept that focuses on identifying specific price zones where large institutional orders have been placed. These zones, much like HVNs, are seen as key areas of interest because of the significant buying or selling activity that has occurred there:

Order Blocks: In ICT’s methodology, order blocks are zones that form when large institutional traders execute their orders. These areas become critical levels of support or resistance because, when price revisits them, it tends to react due to the lingering volume of orders left by these institutions. Traders using order blocks aim to identify these zones as points for entering or exiting trades, aligning their moves with the expected institutional activity.

The Overlap: Order Blocks and High Volume Nodes

Both Order Blocks and HVNs are grounded in the idea of tracking institutional activity through volume and price. Here’s how they align:

Volume as a Key Indicator:

HVNs: HVNs are directly tied to volume, representing price levels where significant trading volume has occurred. This volume is often a result of institutional activity.

Order Blocks: While not explicitly based on volume profiles, order blocks also signify areas where large orders - and therefore significant volume - have been placed by institutions. The reaction at these levels is often due to the residual impact of this volume.

Strategic Price Levels:

HVNs: HVNs act as strong areas of support or resistance, where price tends to consolidate or reverse due to the high concentration of trading activity.

Order Blocks: Similarly, order blocks are viewed as critical price zones that attract price action, offering traders potential entry and exit points aligned with institutional behavior.

Institutional Activity Focus:

HVNs: HVNs reflect the areas where institutions have found fair value, as indicated by the high volume of trades.

Order Blocks: Order blocks are identified as zones where institutions have placed significant orders, often leading to strong price reactions when these levels are revisited.

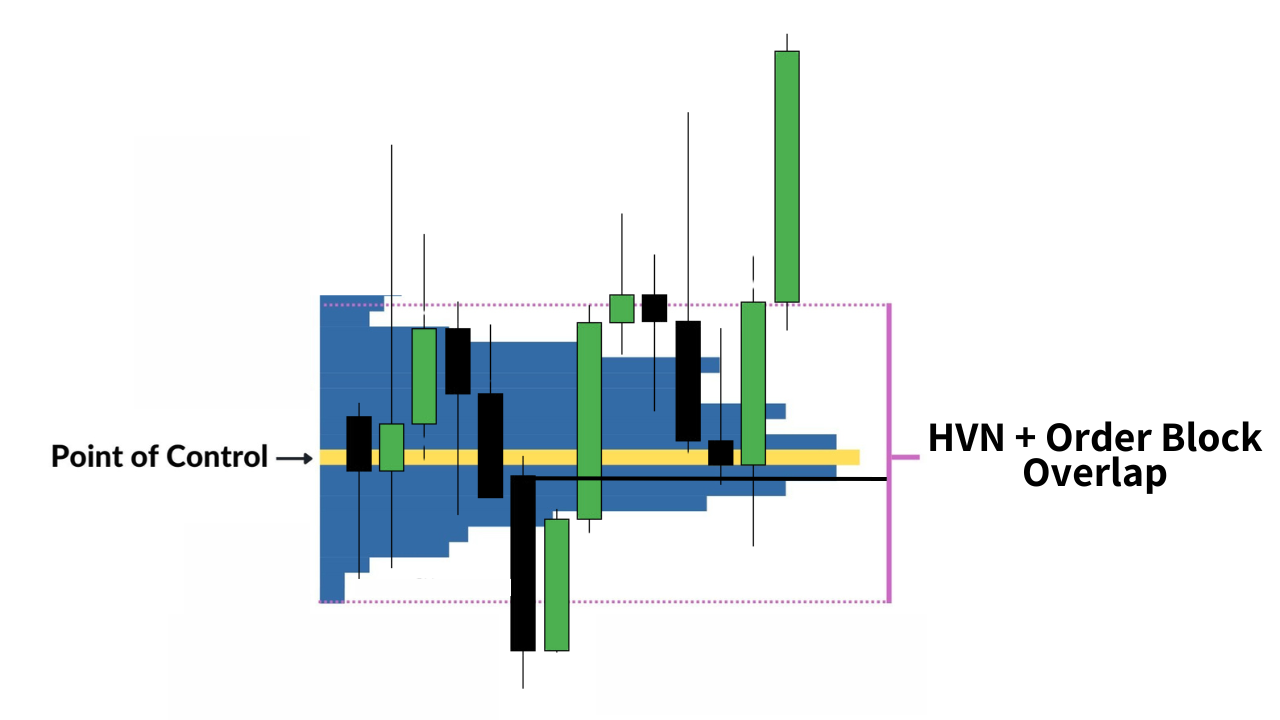

To really emphasis the overlap of these concepts, it’s best to use a visual. Using the same order block graphic shared earlier, we can see what that same setup would look like with volume profile overlayed on the chart. With this visual, you really start to see how the concept of order blocks are just a more complex way to describe simple techniques.

From Steidlmayer to ICT: The Evolution of Order Blocks

It’s likely that ICT’s concept of order blocks has roots in the foundational ideas laid out by Steidlmayer’s volume profile analysis, particularly the concept of High Volume Nodes (HVNs). While ICT has refined and popularized the idea of identifying specific zones where institutions place their orders, the underlying principle of focusing on areas of significant market activity is clearly reminiscent of Steidlmayer’s work.

Steidlmayer's HVNs offer a more straightforward, objective, and simple method of analysis. By identifying price levels with the highest trading volumes, HVNs provide clear and quantifiable areas where market participants have found consensus on value. This simplicity and objectivity make HVNs a powerful tool for traders who prefer a more data-driven approach to identifying areas where larger market participants might be positioning.

In contrast, order blocks, while offering “precision” (if identified correctly, which is one of their many flaws) require more subjective interpretation and deeper understanding of market dynamics. The concept of order blocks takes the basic idea of HVNs and adds a layer of nuance by focusing on the specific behavior of institutional players at certain price levels using candlestick analysis. However, for many traders, especially those new to technical analysis, HVNs may offer an easier and more reliable method for identifying these areas.

By acknowledging the connection between these two concepts, traders can appreciate how ICT’s order blocks have evolved from Steidlmayer’s pioneering work on volume analysis. However, for those seeking a simpler and more objective approach, focusing on HVNs may be a more effective strategy, providing clear, data-backed levels that reflect where the market has historically concentrated its activity.

Conclusion: Tracing the Evolution of Market Analysis

Order Blocks and High Volume Nodes both aim to illuminate the behavior of institutional traders by focusing on key price levels where significant market activity has occurred. While these concepts come from different analytical traditions, the overlap between them suggests that ICT’s order blocks may have evolved from the foundational principles of Steidlmayer’s volume profile analysis.

In a market environment where the actions of large players dictate price movements, understanding these critical concepts is invaluable. That being said, if you are a new or developing trader that is looking to identify areas of potential institutional involvement, look no further than the simplicity of volume profile and specifically high volume nodes. Volume profile continues to be a foundational building block of the trading mentorship that we offer to our members.