The Perils of 0DTE Options Trading: Why Day Traders Should Think Twice

0DTE options means that the specific option contracts has zero days until expiration. These options have gained popularity as a high-risk, high-reward trading instrument in recent years, especially with the advent of daily expirations in SPX. These ultra-short-term options promise quick profits, but as we'll explore in this article, they come with significant dangers that can leave even seasoned day traders with a blown portfolio. A recent study titled “Retail Traders Love 0DTE Options... But Should They?” highlights the issue with trading these products. Is the juice worth the squeeze?

The Allure of 0DTE Options

Day traders are attracted to 0DTE options for several reasons. These options provide the opportunity to capitalize on intraday market movements, offering potential profits in a matter of hours or even minutes. With no time left until expiration, 0DTE options are highly leveraged, amplifying gains and losses. Traders are drawn to the excitement of quick wins and the potential for substantial profits.

The Hidden Pitfalls

However, beneath the allure lies a minefield of hidden pitfalls that can quickly turn the dream of fast riches into a blown portfolio, as revealed by recent research.

Extreme Volatility

If you have ever traded same-day expiring options, you’ll know this to be true: These contracts are highly sensitive to price movements in the underlying asset. Even slight fluctuations can lead to substantial gains, but more importantly, they can also result in devastating losses. The combination of high leverage and volatility can wipe out trading accounts in seconds.

Limited Time

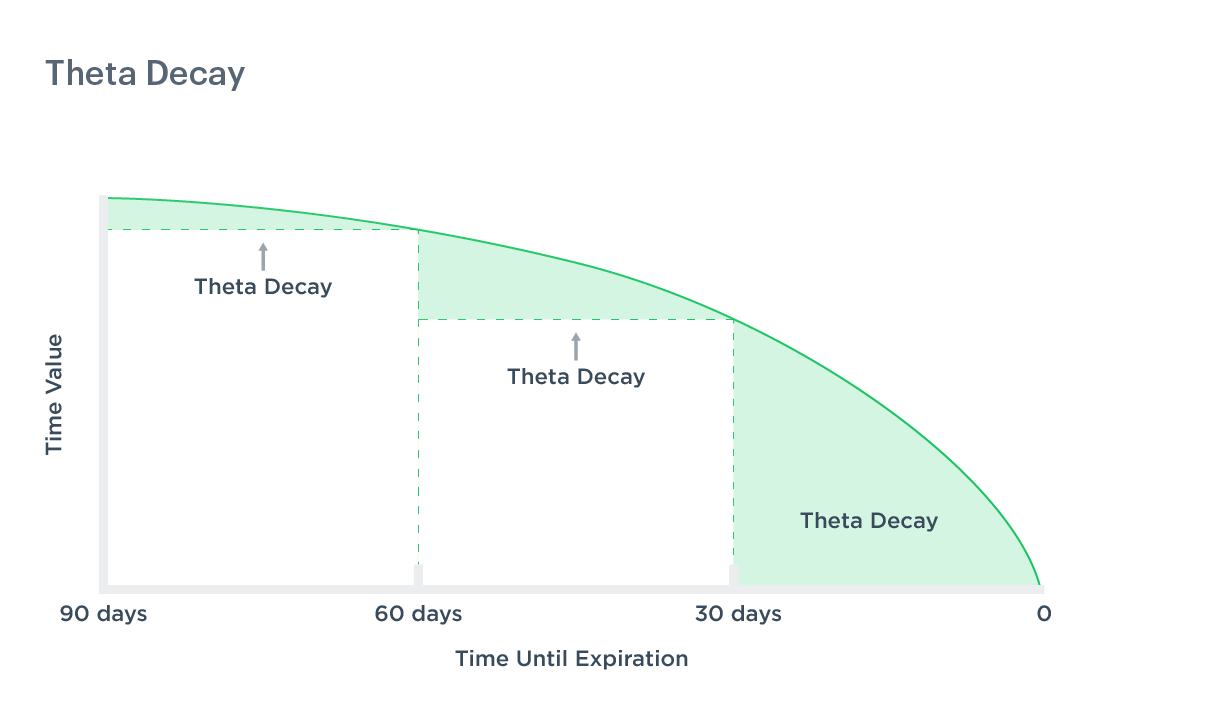

The same study highlighted that with no time left until expiration, 0DTE options offer traders no room for error. Predicting short-term price movements is challenging, and traders must make split-second decisions. A single unexpected market event can erase profits and trigger losses, and unless you have orders already in the broker, many of these moves happen faster than you can react. Not to mention, time is a 0DTE trader’s enemy. If you trade 0DTE options, you can frequently be right on the direction of the stock and still lose money. This is one of the byproducts of theta decay. I have personally experienced this countless times, which is why I primarily focus on trading futures now.

Evidence from the Market

The comprehensive study analyzing the performance of retail traders in 0DTE options sheds light on the grim reality. According to the research, more than 75% of retail investors' trades in S&P 500 options today are in 0DTE contracts. However, despite the allure of lower effective spreads, retail investors experience losses on average. Between February 2021 and February 2023, retail investors lost $184,000 on the average day. Since the introduction of a daily expiration calendar in May of 2022, this number has grown to average losses of $358,000 per day.

Emotional Stress

The rapid pace of trading 0DTE options, as indicated by the study, can lead to extreme emotional stress. Traders are constantly under pressure to make quick decisions, and this can lead to impulsive, emotion-driven trading, which rarely ends well.

alternatives to 0dte

Consider safer and potentially more profitable alternatives to 0DTE options, such as trading E-mini S&P 500 (ES) and E-mini Nasdaq 100 (NQ) futures contracts. These futures provide greater control and flexibility, lower transaction costs, and immunity to time decay. They offer leverage without the theta decay associated with options, ensuring your leverage remains intact throughout your trade. Their liquidity, transparency, and risk management tools make them a safer choice for day traders, mitigating the extreme risks and price volatility of 0DTE options. If you are serious about trading SPY, SPX, or QQQ options, then switching to ES or NQ futures is a much smarter choice. The usual argument against futures is that they generally require a larger account - This is no longer true with funding programs like Topstep and a number of brokers offering great margins. As someone who has traded options full-time for 7+ years, take it from me: futures are a better trading product.

Conclusion: Proceed with Caution

The study finds that while the allure of 0DTE options may be tempting, day traders should proceed with extreme caution, as the vast majority are losing money hand over fist. The potential for quick profits is undeniably appealing, but the risks are disproportionately high, especially with better trading products (like futures) available.

The evidence suggests that many retail traders struggle to profit from these ultra-short-term contracts, and the odds are often stacked against them, a reality laid bare by the research's empirical data. Before diving into 0DTE options trading, day traders should consider their risk tolerance, trading strategy, and experience level carefully. It's crucial to approach these instruments with a well-thought-out plan, strict risk management rules, and a clear understanding of the potential dangers involved, all backed by the sobering data provided by recent research. For many, the best choice may be to steer clear of the allure of 0DTE options and focus on less risky trading strategies and products.