Options Flows on SPX Price Action - A breakdown of Gamma, Vanna, and Charm

In the world of financial markets, where headlines and narratives often take center stage, it's essential to recognize what is actually exerting a profound influence on SPX price dynamics. Options have emerged as the new bedrock, with SPX functioning as the derivative. Tail wagging the dog scenario. For traders engaged in the SPX, ES (futures), or SPY, understanding the ramifications of options flows is paramount - But is this information really needed to be consistently profitable, or is it just noise? In this article, we'll delve into the complex realm of options trading, exploring how it molds the movements of the S&P 500, and whether or not it is something you should be monitoring.

Meet Martin: The Market Whale

Picture a market maker named Martin. His primary responsibility is to handle SPX options, acting as the crucial intermediary that enables hedge funds, pension funds, portfolio managers, and other market participants to execute their options trades. Martin's role is pivotal because he provides liquidity, the lifeblood of financial markets. Notably, Martin is often referred to as a "whale" in the industry due to the immense volume of SPX options that flow through his hands.

However, Martin encounters a unique challenge. Unlike brokers, he cannot always immediately offset the trades he executes with others. This leaves him exposed to risks that require astute management. To mitigate these risks, Martin employs a technique known as delta hedging. Delta hedging entails adjusting his positions to neutralize the directional risk associated with the options he trades.

The Significance of Liquidity

Martin's daily routine commences with an examination of the SPX Index Market Depth Monitor (MDM) on Bloomberg, where he scrutinizes the order book. He looks for tight spreads on the best bid/offer, an abundance of quotes in both directions and substantial market depth. These elements are crucial for executing effective delta hedging.

The presence of abundant liquidity equips Martin with the ability to offer options at more competitive prices and enhance his trading volume. When purchasing options, he ensures that he does not pay more than he can recover through delta hedging. A robust order book makes it arduous for the S&P 500 index to experience significant price fluctuations.

Gamma, Vanna, and Charm: The Trio of Options Influence

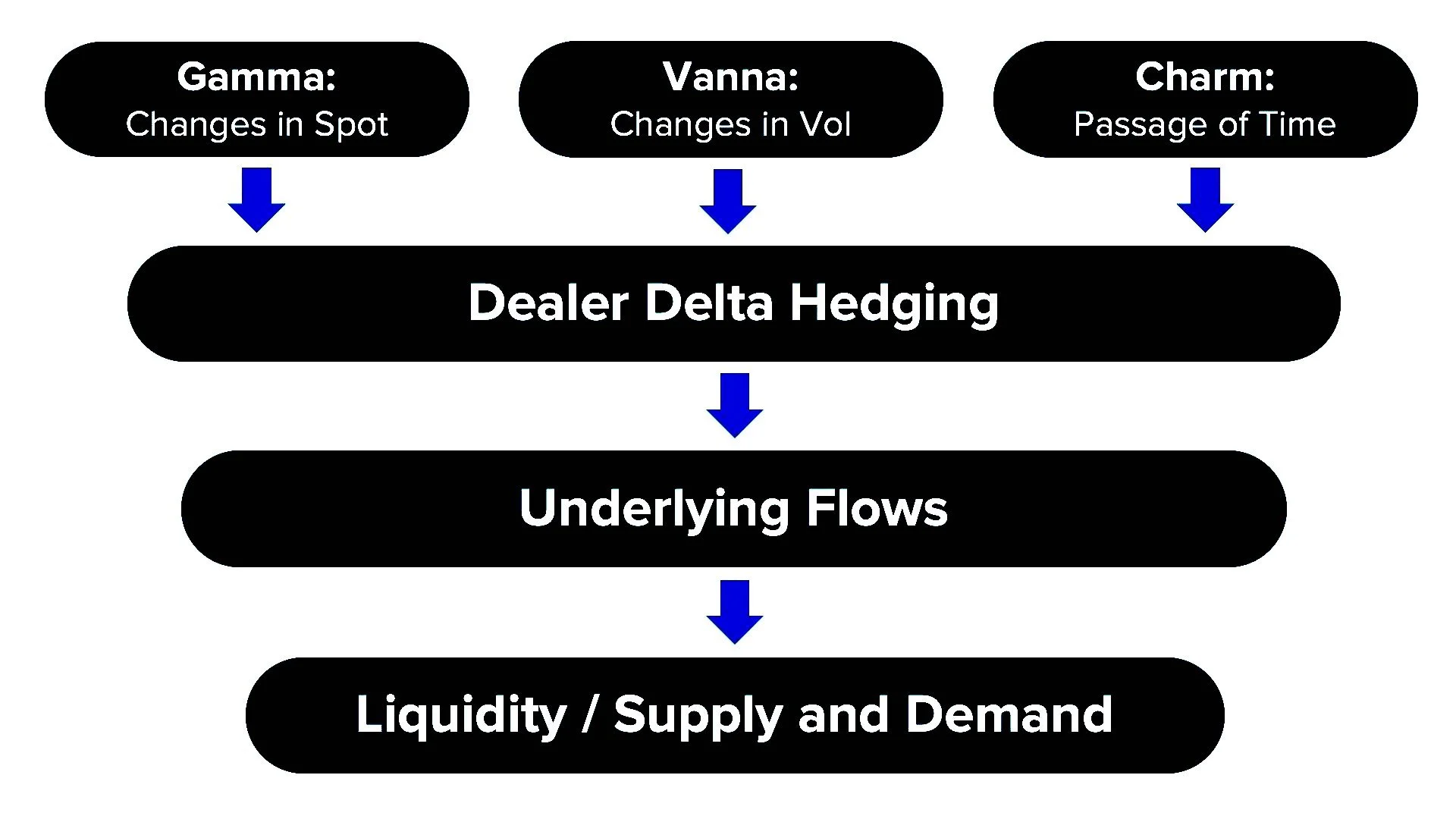

As Martin navigates his daily tasks, he grapples with three pivotal factors that exert an impact on his options trading endeavors: Gamma, Vanna, and Charm.

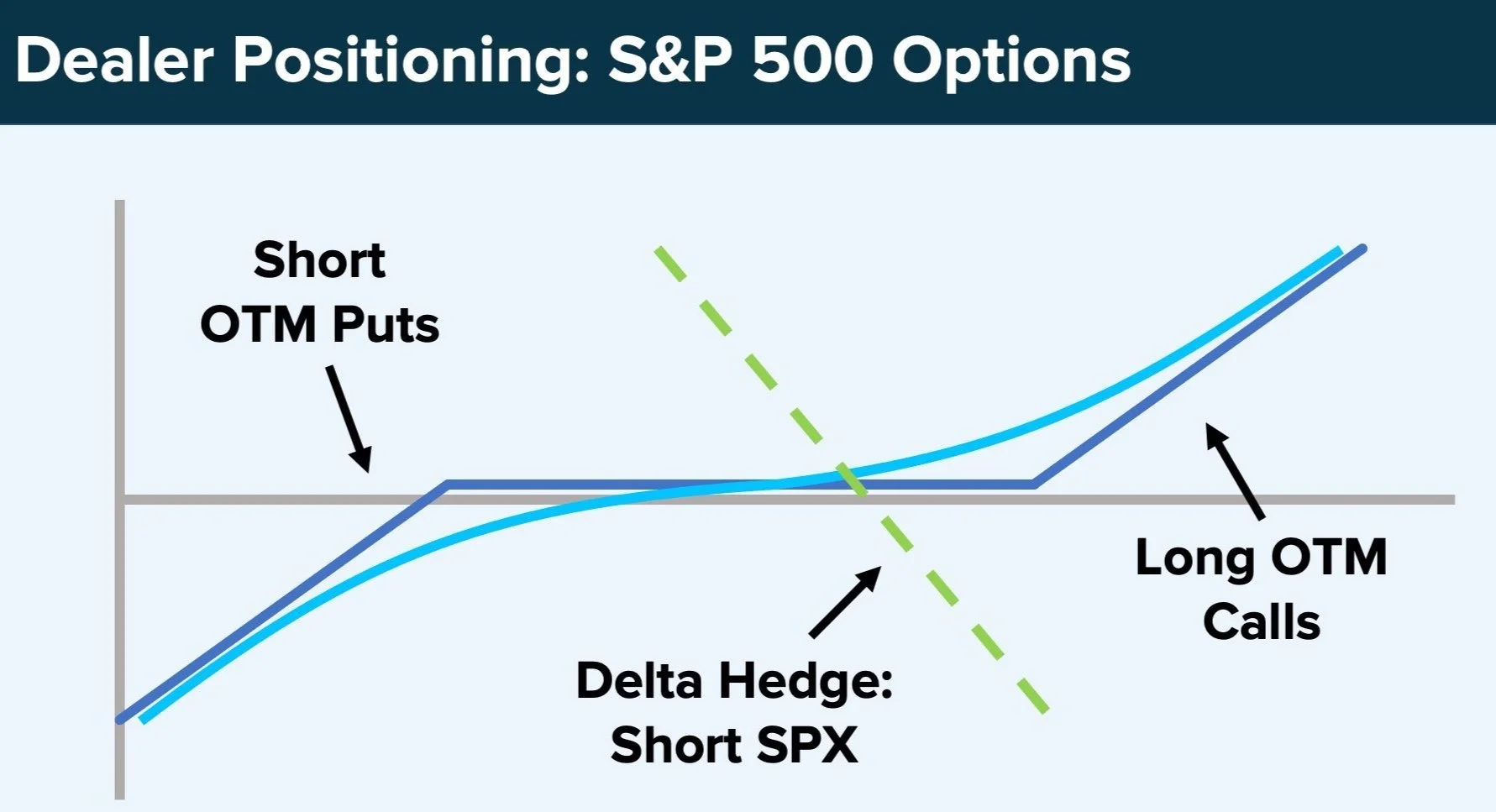

Gamma measures the shift in delta concerning the underlying price. In times of market stability, Martin frequently finds himself holding long out-of-the-money (OTM) calls, thereby accumulating positive gamma. This implies that if the index ascends, the options gravitate toward being at-the-money (ATM) or in-the-money (ITM), causing his delta to approach 1. To counterbalance this effect, he must sell SPX.

Vanna gauges the alteration in delta associated with implied volatility. As implied volatility diminishes and options approach their expiration, delta tends to approach zero. Vanna quantifies this phenomenon. Consequently, Martin may need to rebalance his hedge by repurchasing some of his SPX shorts.

Charm quantifies the change in delta with respect to the passage of time. As options draw nearer to expiration, they become more economical, and their deltas tend toward zero. Charm, in conjunction with Vanna, plays a role in diminishing deltas as options approach their due dates. For Martin, this translates into heightened hedging activity, potentially influencing the index.

The Ripple Effect on the Market

Given Martin's role as a market maker and his substantial exposure to SPX options, his delta hedging activities wield a substantial impact on the underlying market. His trading flows are anything but inconsequential, frequently influencing the market's trajectory.

Understanding these flows can be helpful to traders seeking to navigate the SPX market effectively. Changes in dealer positioning, open interest, volatility levels, and their movements all contribute to determining the size and direction of these flows.

Options Expiry and Beyond

These dynamics manifest most prominently in the lead-up to Options Expiry (OpEx) week, with their effects extending into the third week of the month. During this period, Martin's trading activities can lead to a gradual ascent in the SPX.

However, after OpEx, Gamma, Vanna, and Charm expire, they liberate the index from the clutches of option hedging flows. This is frequently called “unclenching.” This juncture can create a window of vulnerability, rendering the index more responsive to other market-moving factors.

As the month's end draws near, Vanna and Charm resurface, once again influencing the market's dynamics. Although these dynamics do not conform to an exact science and hinge on various market factors, understanding them can elucidate some of the observed movements in SPX around OpEx.

The Balance of Options and Technicals

While delving into the intricacies of options flows provides invaluable insights into SPX price movements, it's important to acknowledge that technical traders can find reassurance in the fact that, fundamentally, the S&P 500 products (SPX, ES, and SPY) still adhere to technical analysis. Technical indicators and chart patterns remain influential in guiding trading decisions, offering a supplementary perspective amid the complexities of options trading dynamics. Much of the flows that Martin has to deal with are from retail traders crowded into 0DTE options - Retail traders by and large watch technicals. This harmonious coexistence between technical analysis and options flow analysis empowers traders to make well-rounded, informed choices in the ever-evolving realm of financial markets.

Personally, I used gamma walls and these option flows as an assist to my overall technical edge - But what I found was that more than 90% of the time, this data was just pointing me in a direction that I was already getting from technical analysis. Can the data be used to add conviction? Of course, but I am a big proponent in the “less is more” approach to trading - So any “noise” within the system is cut. After using the data for 2+ years, I can firmly say that I don’t miss it. If you’re on the fence about whether or not to incorporate some aspects of this data, I would tell you to pass. Keep the focus on the technicals, as technical analysis always tells us what we need to know. Price action never lies.

In conclusion, the options market, with its intricate web of delta hedging and volatility dynamics, constitutes a potent force steering SPX price action. By gaining insight into the mechanics of this market, traders can find some assistance in navigating the complexities of the S&P 500 more adeptly and make more informed decisions. That being said, is it required? Will it improve your edge? From what I have found, the answer to that question is no. This information (gamma) is going to overwhelm new and developing traders, only slowing their learning curve.