Bid Size and Ask Size on Option Contracts - How You Can Use It To Your Advantage

Bid size and ask size is an important consideration for stock traders, and it is information that options traders should be using to their benefit as well. When the particular option contract you would like to trade has a bid size that is radically different from the ask size, it can represent a supply and demand imbalance. This imbalance can influence the direction of the contract’s prices if an order is filled at or above the current ask price with substantial volume.

What is Bid Size & Ask Size?

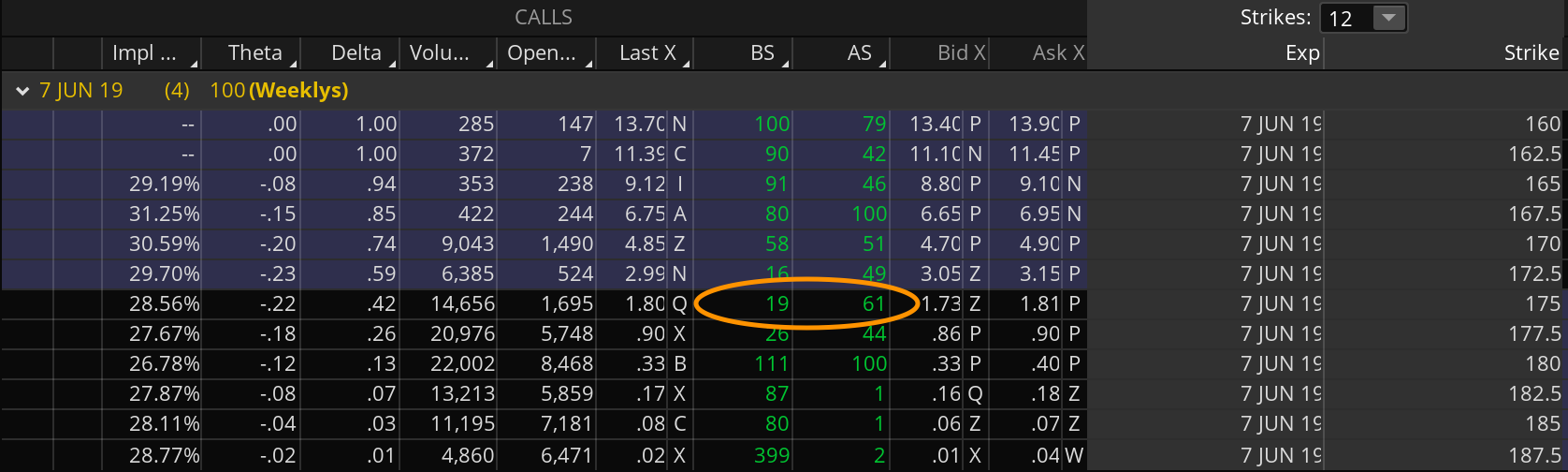

Bid size represents the minimum number of option contracts that a trader (or investor) is willing to purchase at a specified bid price. The bid size also represents how many contracts the market is willing to buy at the bid price, which can be interpreted as the entire market demand for those contracts. If the bid size is higher than the ask size, then there is more buying demand than selling demand for that particular contract at that price, and vice versa. In the graphic below, you can see the $AAPL 6/7/19 expiration 175 strike call having a Bid Size of 19, and an Ask Size of 61. This would tell you that there is a far greater supply of these contracts than there is demand. The higher the ask size, the more supply there is that traders and market makers want to sell.

Option chain showing bid size of 19 and ask size of 61 (orange oval) on the $AAPL 6/7/19 expiry 175 strike calls

Higher supply on the contracts in this scenario does not necessarily indicate that the underlying stock is bearish or bullish, and I don’t use bid size and ask size as a clue into what price action on the underlying stock might be doing. Instead, I prefer to use bid size and ask size as a “gauge” when I am filling my buy orders and my sell orders.

Hopefully, you already know that the bid / ask spread is important, and a tighter spread means higher liquidity and better fills on our options contracts. You should also know that using limit orders is generally the best and safest way to trade when it comes to both buying and selling options. That being said, there are occasions when time is of the essence and a market order would be acceptable. Assuming the bid/ask spread is tight enough to meet your personal risk tolerance, you can look to the bid size and ask size to determine if a market order is going to be reasonable.

For example, using the graphic above: if you want to purchase 10 contracts of the $AAPL 06/07/19 expiry 175 strike calls and you are comfortable with the asking price, you would look to the ask size and see that all 10 of your contracts will fill at the $1.81 asking price. Why? Because the ask size tells you there are 61 contracts available at this price. In this hypothetical scenario, it would be reasonably safe to proceed with purchasing at the ask with a market order.

However, if you wanted to purchase 10 contracts of the $AAPL 06/07/19 expiry 182.5 strike calls and you are comfortable with the asking price, you would look at the ask size and likely elect to use a limit order, instead of the market order used in the previous example. Why? Because the ask size for the 182.5 strike call is only 1, which means a market order is going to fill one contract at the $.18 price and the other nine contracts at the next available (higher) price. This scenario could potentially put you, the trader, at increased risk.

Expanding on this, there is another manner in which traders can use bid size and ask size advantageously. Using the same graphic from above, you see that the $AAPL 06/07/19 expiry 182.5 strike calls have a total spread of 0.08 between the 1.73 bid and 1.81 ask price. These particular contracts are more heavily weighted on the ask side, with a bid size of 19 and an ask size of 61. When trading contracts with tight spreads, it is good practice to set your limit orders at the mid-price (middle of the spread). However, seasoned options traders will know that you can’t always get a fill at the mid-price! This is where the bid size and ask size can help you - spreads that are more heavily weighted on the ask will likely have an easier time being filled closer to the ask and vice versa.

In summary, traders can use the bid size and ask size to determine at a glance if a market order will get filled in its entirety at the asking price, or if they should instead use a limit order. Traders can also use the bid size and ask size to quickly determine the likelihood that they will be filled at the mid-price, or if some adjustments will need to be made. Have you used bid size and ask size in this manner before? Comment below!